EX-10.1

Published on December 3, 2025

Exhibit 10.1

Captivision Inc.

601 Brickell Key Drive, Suite 700

Miami, FL 33131

November 24, 2025

CONFIDENTIAL

Montana Goldfields, Inc.

1610 Wynkoop Street, Suite400

Denver, CO 80202

Attn: Patrick Imeson

Re: Letter of Intent

Dear Mr. Imeson,

This letter of intent (this “LOI”) outlines the general terms and conditions of a potential business transaction (the “Proposed Transaction”) involving Captivision Inc., a Cayman Islands exempted company (Nasdaq: CAPT) (the “Company”), and Montana Goldfields, Inc., a Delaware corporation ( “Montana Goldfields”) and relating specifically to the acquisition by the Company of Montana Tunnels Mining, Inc., a wholly owned subsidiary of Montana Goldfields (“MTMI”). By executing this LOI, the parties confirm their agreement to negotiate the Definitive Agreements (as defined below) on substantially the terms and conditions as set forth herein and in the non-binding term sheet in Exhibit A hereto (the “Term Sheet”). References hereinafter to this LOI shall be deemed to include the Term Sheet.

1

2

3

{Remainder of Page Intentionally Left Blank; Signature Page(s) Follow(s)}

4

Please acknowledge your acceptance of and agreement with the foregoing by signing and returning to the undersigned as soon as possible a counterpart of this LOI.

Sincerely,

Captivision Inc.

By: _/s/ Gary R. Garrabrant________

Name: Gary R. Garrabrant

Title: Chief Executive Officer

5

Accepted and agreed to by the undersigned as of the date first above written:

Montana Goldfields, Inc.

By: _/s/ Patrick Imeson___________

Name: Patrick Imeson

Title: Chief Executive Officer

6

Exhibit A – NON-BINDING TERM SHEET

This Term Sheet is attached to and forms a part of an LOI intended to set forth the material financial and business terms and conditions of the Proposed Transaction. However, all such terms and conditions are subject to further refinement and detail as the parties shall mutually agree, as shall be set forth in the Definitive Agreements. All capitalized terms used in this Term Sheet and not otherwise defined herein shall have the respective meanings ascribed to such terms in the LOI to which this Term Sheet is attached.

Proposed Transaction: |

The Proposed Transaction is intended to consist of the acquisition by the Company of 100% of the outstanding equity and equity equivalents (including options, warrants or other securities that have the right to acquire or convert into equity securities) of MTMI , which owns the legacy Montana Tunnels permitted mine and related mining and milling plant and equipment, from Montana Goldfields in exchange for the issuance to Montana Goldfields of the Transaction Shares (as hereinafter defined and described in Transaction Consideration below. Notwithstanding the foregoing, (Montana Goldfields and the Company will jointly determine the optimum transaction structure for the Proposed Transaction for execution efficiency and tax purposes based on the due diligence findings as well as business, legal, tax, accounting and other considerations, which may include structuring the Proposed Transaction, including through a tax election, as an asset purchase transaction rather than as an equity acquisition. The Transaction Shares will be issued by the Company to Montana Goldfields in a private placement exempt from registration under the Securities Act of 1933, as amended (“Securities Act”) and the Proposed Transaction will proceed without Company shareholder approval in reliance on the exemption provided to foreign private issuers under Nasdaq’s Series 5600 rules. The Proposed Transaction will be treated as a combination transaction requiring a new listing application under Nasdaq Rule 5110(a). |

Reverse Split of Ordinary Shares |

If and to the extent required to meet Nasdaq requirements for continued listing of the Company’s Ordinary Shares (the “Ordinary Shares”), the Company shall amend its memorandum and articles of association (“MMA”) as necessary to provide for, and shall timely effect, a reverse split of its Ordinary Shares on a 1:10 basis or such ratio as required for continued listing (the “Reverse Split”). |

ROFO: |

The Definitive Agreements will contain a right of first refusal, in favor of the Company, exercisable for a period of two years following the Closing, to acquire other mining and milling assets owned by Montana Goldfields and its subsidiary Elkhorn Goldfields Inc., including the permitted Diamond Hill mine, the permitted Golden Dream deposit and three Elkhorn deposits, on terms to be negotiated by the Company and Montana Goldfields. |

Transaction Consideration: |

The total consideration provided to or for the benefit of Montana Goldfields and/or its equity holders (including holders of options, warrants and other convertible securities), as applicable, in the Proposed Transaction (the “Transaction Consideration”) is based on a total pre-transaction equity value of Montana Goldfields of $750 million and the Company of $50 million. The Transaction Consideration to be paid by the Company will consist of issuance by the Company |

7

|

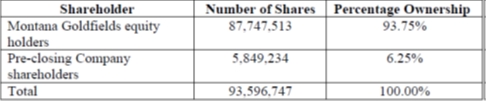

of Ordinary Shares, which would be issued by the Company based on the 1:15 ratio of the foregoing relative valuations (the “Transaction Shares”). Based on 58,492,342 fully diluted Ordinary Shares outstanding as of the date hereof (and giving effect to the planned 1:10 reverse share split), the share ownership following the issuance of the Transaction Shares will approximate as follows:

The number of shares and percentage ownership will reflect the Ordinary Shares outstanding as of the Closing. |

Lock-Up & Registration Rights: |

All Transaction Shares to be issued in the Proposed Transaction will be subject to the following conditions and protections: (a) a lock-up for a period of up to six months following the Closing; and (b) all applicable holding periods and requirements under the Securities Act and applicable rules thereunder. The Company and Montana Goldfields will enter into a registration rights agreement providing Montana Goldfields with demand registration rights, exercisable for a period of time and commencing at such time as the parties shall mutually agree, and customary piggyback registration rights relating to future issuances and sales of the Company’s Ordinary Shares, subject to such terms and conditions as are customary in transactions of the nature of the Proposed Transaction, including with respect to customary and reasonable underwriter cooperation provisions and “cutback” limitations. |

Employment Arrangements: |

Certain executives of Montana Goldfields and/or MTMI (to be identified by Montana Goldfields and agreed to by the Company) and the Company will enter into mutually acceptable employment agreements with the Company, which will include customary confidentiality, non-compete and other restrictive covenant provisions as are customary in transactions of the nature of the Proposed Transaction and their respective positions. The Company’s long-term incentive/equity plan will remain in effect post-Closing. |

Board of Directors/ Executive Management: |

The Company will amend its MMA or take board action, as is necessary, to fix the size of its board of directors (the “Board”) at 7 directors with four directors appointed by Montana Goldfields, including Thomas Hennessy. The composition of the Board must satisfy the Nasdaq listing requirements. Gary Garrabrant and Patrick Imeson will be appointed by the Board, effective upon Closing, to serve as co-chairman of the Board and Gary Garrabrant will be appointed by the Board, effective upon Closing, to serve as the interim chief executive officer of the Company until a successor is identified and appointed. Prior to the Closing, the Board will initiate an executive search for an “industry veteran” president (to serve as a potential successor chief executive officer of the Company) and chief financial officer of the Company. |

8

Acquisition Agreement: |

The obligations of the parties will be subject to execution of the Definitive Agreements, each containing terms and conditions satisfactory to the Company and Montana Goldfields. The execution of the Definitive Agreements will also be subject to completion of respective and reasonably satisfactory due diligence investigations by each of the Company and Montana Goldfields, and • if required by SEC regulations, the delivery of PCAOB audited financial statements of MTMI for the years ended December 31, 2023 and December 31, 2024 and unaudited interim financial statements of MTMI. • the Company’s filing of its Form 20F annual report (including audited financial statements for the years ended December 31, 2023 (as restated as applicable) and December 31, 2024 and submission of Form 6-K containing unaudited interim financial statements for the period ended June 30, 2025; • completion of a super Form 6-K containing Form 20F compliant information for post-acquisition company; • as necessary for continued listing on Nasdaq of the Ordinary Shares (including the Transaction Shares), the implementation of the Reverse Split in a ratio of at least 1:10; and • the receipt of a listing approval letter from Nasdaq approving the reverse acquisition and continued listing. The Acquisition Agreement will contain representations, warranties, covenants and closing conditions provisions customary for transactions of the nature of the Proposed Transaction, as well as a general release by Montana Goldfields and any other MTMI equity holders. |

Survival: |

Neither Montana Goldfields nor the Company will provide any indemnification under the Acquisition Agreement, and neither party’s representations, warranties and covenants will survive the Closing (except for those covenants, which by their express terms, survive or are to be performed after the Closing). |

Closing Conditions: |

The obligations of each party to consummate the Proposed Transaction are subject to closing conditions customary in transactions of the nature of the Proposed Transaction, including without limitation: (a) the Company’s Nasdaq continued listing approval remaining in effect, receipt of any required regulatory approvals and necessary third party approvals, and expiration of any waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 or other applicable anti-trust laws, (ii) the Company’s receipt of a fairness opinion as to fairness from a financial point of view of the Proposed Transaction , (iii) approval of the Proposed Transaction and related matters by Montana Goldfields, MTMI’s sole equity owner, as is required by applicable law, (iv) all of the outstanding options and warrants, and all other convertible securities of MTMI shall have been converted into equity of the Company or cancelled prior to the Proposed Transaction, and any rights to acquire equity of MTMI will be extinguished as of the Closing and replaced with corresponding rights to acquire equity of the Company, (v) there shall have not been any material adverse changes in the business, customer relationships, operations, financial condition, regulatory environment or prospects of MTMI, and (vi) the execution of all of the other Definitive Agreements as contemplated by the Acquisition Agreement including lockup agreements, non-compete and non-solicitation agreements, and employment agreements. |

9

Filings: |

As soon as practicable following the execution of the Acquisition Agreement, the parties will file all submissions required for applicable shareholder, regulatory and governmental approval. |

No Third-Party Beneficiaries |

Nothing herein is intended or shall be construed to confer upon any person or entity other than the parties and their successors or assigns, any rights or remedies under or by reason of this Term Sheet. |

Governing Law: |

The Acquisition Agreement and other Definitive Agreements will be governed by New York law and jurisdiction as provided in the LOI. |

Non-Binding Nature of LOI and Term Sheet |

This Term Sheet and the LOI to which it is attached and forms a part of reflect the current intention of the parties, but none of such LOI, this Term Sheet or acceptance thereof shall give rise to any legally binding or enforceable obligation on the part of any of they, except with regard to this section and the sections hereof titled “Confidentiality,” “Expenses,” “Governing Law” and “Third-Party Beneficiaries.” No contract or agreement providing for any transaction involving Montana Goldfields or MTMI will be deemed to exist between or among any of the parties or any of their respective affiliates unless and until final Definitive Agreements have been executed and delivered by the same. |

10