20-F/A: Annual and transition report of foreign private issuers pursuant to Section 13 or 15(d)

Published on May 24, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission File Number:

(Exact name of Registrant as specified in its charter)

Not applicable |

|

(Translation of Registrant’s name into English) |

(Jurisdiction of incorporation or organization) |

(Address of principal executive offices)

Telephone: (

Email:

At the address of the Company set forth above

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of exchange on which registered |

The |

||

The |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

☒ |

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting over Section 404(b) of the Sarbanes‑Oxley Act (15

U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive‑based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D‑1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ☐ |

Other ☐ |

|

|

by the International Accounting Standards Board ☒ |

|

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑ 2 of the Exchange Act). Yes ☐ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐Yes ☐No

Auditor Firm ID: |

Auditor Name: |

Auditor Location: |

EXPLANATORY NOTE

TABLE OF CONTENTS

|

7 |

|

|

|

|

ITEM 1. |

7 |

|

|

|

|

ITEM 2. |

7 |

|

|

|

|

ITEM 3. |

7 |

|

|

|

|

ITEM 4. |

43 |

|

|

|

|

ITEM 4A. |

62 |

|

|

|

|

ITEM 5. |

62 |

|

|

|

|

ITEM 6. |

102 |

|

|

|

|

ITEM 7. |

115 |

|

|

|

|

ITEM 8. |

121 |

|

|

|

|

ITEM 9. |

121 |

|

|

|

|

ITEM 10. |

122 |

|

|

|

|

ITEM 11. |

131 |

|

|

|

|

ITEM 12. |

132 |

|

|

|

|

|

132 |

|

|

|

|

ITEM 13. |

132 |

|

|

|

|

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

132 |

|

|

|

ITEM 15. |

132 |

|

|

|

|

ITEM 16. |

133 |

|

|

|

|

ITEM 16A. |

133 |

|

|

|

|

ITEM 16B. |

133 |

|

|

|

|

ITEM 16C. |

133 |

|

|

|

|

ITEM 16D. |

134 |

|

|

|

|

ITEM 16E. |

PURCHASE OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

134 |

|

|

|

ITEM 16F. |

134 |

|

|

|

|

ITEM 16G. |

134 |

|

|

|

|

ITEM 16H. |

135 |

|

|

|

|

ITEM 16I. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

135 |

|

|

|

ITEM 16J. |

135 |

|

|

|

|

ITEM 16K. |

135 |

|

|

|

|

|

137 |

|

|

|

|

ITEM 17. |

137 |

|

|

|

|

ITEM 18. |

137 |

|

|

|

|

ITEM 19. |

137 |

‑ i ‑

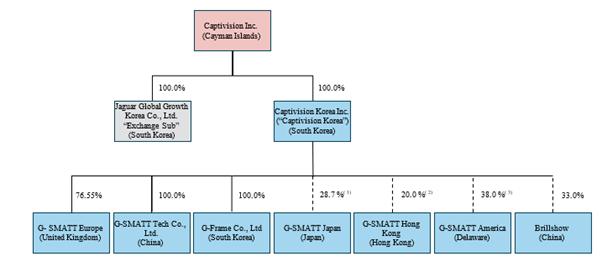

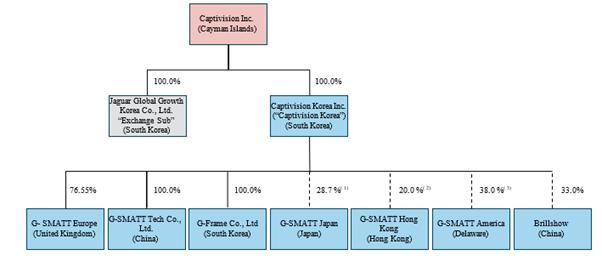

Conventions That Apply to This Annual Report on Form 20‑F

In this annual report on Form 20‑F, unless otherwise designated, the terms “we,” “us,” “our,” “Captivision,” “the Company” and “our Company” refer to Captivision Inc., an exempted company incorporated with limited liability in the Cayman Islands, and its consolidated subsidiaries, (ii) “JGGC” refers to Jaguar Global Growth Corporation I, a Cayman Island exempted company, (iii) “Captivision Korea” refer to Captivision Korea Inc. (f/k/a GLAAM Co., Ltd.), a corporation (chusik hoesa) organized under the laws of the Republic of Korea, and (iv) “W” and “KRW” refer the South Korean Won.

Unless we indicate otherwise, references in this annual report to:

“Business Combination” means the Merger, the Share Swap and the other transactions contemplated by the Business Combination Agreement, collectively.

“Business Combination Agreement” means the Business Combination Agreement, dated as of March 2, 2023, as amended as of June 16, 2023, July 7, 2023, July 18, 2023 and September 7, 2023 by and among JGGC, Captivision Korea, Jaguar Global Growth Korea Co., Ltd, and the Company.

“Captivision”, the “Company” and “we” means Captivision Inc. (formerly known as Phygital Immersive Limited), an exempted company with limited liability under the laws of the Cayman Islands, together with its direct and indirect subsidiaries.

“Captivision Korea” means Captivision Korea Inc. (formerly known as GLAAM Co., Ltd.) a corporation (chusik hoesa) organized under the laws of the Republic of Korea and a subsidiary of the Company.

“Captivision Korea Common Shares” means the common shares, KRW 500 par value per share, of Captivision Korea.

“Captivision Korea Exchange Ratio” means 0.800820612130561.

“Captivision Korea Founder Earnout Letter” means the letter agreement, dated March 2, 2023, by and among the Captivision Korea Founders, the Company, Exchange Sub, JGGC and Captivision Korea, pursuant to which, at the Closing, issued or caused to be issued to the Captivision Korea Founders (in the aggregate), (i) the 1,666,666.67 Series I RSRs, (ii) the 1,666,666.67 Series II RSRs and (iii) the 1,666,666.67 Series III RSRs and setting forth the terms upon which such 5,000,000 Earnout RSRs shall vest and be settled for Ordinary Shares.

“Captivision Korea Founders” means Houng Ki Kim and Ho Joon Lee.

“Captivision Korea Options” means the options to purchase Captivision Korea Common Shares.

“Captivision Korea Shareholders” means the holders of Captivision Korea Common Shares.

“Closing” means the consummation of the Business Combination.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“Companies Act” means the Companies Act (As Revised) of the Cayman Islands.

“Converted Options” means the options to acquire Ordinary Shares issued upon conversion of the Captivision Korea Options, in each case subject to substantially the same terms and conditions as were applicable under the converted Captivision Korea Option, the number of Ordinary Shares (rounded down to the nearest whole share), determined by multiplying the number of Captivision Korea Common Shares subject to the converted Captivision Korea Option as of immediately prior to the Share Swap by the Captivision Korea Exchange Ratio, at an exercise price per Captivision Korea Common Share (rounded up to the nearest whole cent) equal to (x) the exercise price per Captivision Korea Common Share of the converted Captivision Korea Options divided by (y) the Captivision Korea Exchange Ratio.

“Converted Warrants” means, collectively, the Public Warrants and the Private Warrants.

‑ 1 ‑

“DOOH” means digital out of home.

“Earnout Period” means, with respect to the Earnout RSRs, the period commencing at Closing and ending on the third anniversary of the Closing.

“Earnout Shares” means the shares issuable upon settlement of the Earnout RSRs.

“Earnout Strategic Transaction” means the occurrence in a single transaction or as a result of a series of related transactions, of (i) a merger, consolidation, business combination, reorganization, recapitalization, liquidation, dissolution or other similar transaction with respect to the Company, in each case, in which shares of the Company are exchanged for cash, securities of another person or other property (excluding, for the avoidance of doubt, any domestication of the Company or any other transaction in which Ordinary Shares are exchanged for substantially similar securities of the Company or any successor entity of the Company) or (ii) the sale, lease or other disposition, directly or indirectly, by the Company of all or substantially all of the assets of the Company and its subsidiaries, taken as a whole (excluding any such sale or other disposition to an entity at least a majority of the combined voting power of the voting securities of which are owned by holders of Ordinary Shares).

“Earnout RSRs” means, collectively, the Series I RSRs, the Series II RSRs and the Series III RSRs.

“Equity Plan” means the equity incentive plan for employees, directors and service providers of the Company and its subsidiaries in effect as of the Closing.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Exchange Sub” means Jaguar Global Growth Korea Co., Ltd., a stock corporation (chusik hoesa) organized under the laws of the Republic of Korea and wholly owned direct subsidiary of the Company.

“Founder Warrants” means the warrants held by the Captivision Korea Founders that are exercisable for an aggregate of 1,779,368 Ordinary Shares at $11.50 per share.

“FPCB” means flexible printed circuit board.

“GaaS” means glass as a service.

“Governmental Entity” means (a) any federal, provincial, state, local, municipal, foreign, national or international court, governmental commission, government or governmental authority, department, regulatory or administrative agency, board, bureau, agency or instrumentality, tribunal, arbitrator or arbitral body (public or private), or similar body; (b) any self‑regulatory organization; or (c) any political subdivision of any of the foregoing.

“IASB” means International Accounting Standards Board.

“IC semiconductor chip” means an integrated circuit chip.

“IFRS” means International Financial Reporting Standards, as issued by the IASB.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

“IRS” means the U.S. Internal Revenue Service.

“JGGC” means Jaguar Global Growth Corporation I, a Cayman Islands exempted company.

“JGGC Class A Ordinary Shares” means JGGC’s Class A ordinary shares, par value $0.0001 per share.

“JGGC Class B Ordinary Shares” means JGGC’s Class B ordinary shares, par value $0.0001 per share.

“JGGC IPO” means JGGC’s initial public offering of units of JGGC, each consisting of one JGGC Class A Ordinary Share, one JGGC Right and one‑half of one JGGC Public Warrant, which was consummated on February 10, 2022.

‑ 2 ‑

“JGGC Rights” means the rights entitling the holder thereof to receive one‑twelfth of one JGGC Class A Ordinary Share.

“JGGC Sponsor” means Jaguar Global Growth Partners I, LLC, a Delaware limited liability company.

“JGGC Sponsor Earnout Shares” means 1,916,667 Ordinary Shares issued to JGGC’s initial shareholders that are subject to vesting or forfeiture.

“JGGC Public Warrants” means the redeemable warrants, each exercisable to purchase one JGGC Class A Ordinary Share.

“JOBS Act” means Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, as amended.

“LED” means light‑emitting diode.

“Legal Requirements” means any federal, state, local, municipal, foreign or other law, statute, constitution, treaty, principle of common law, resolution, ordinance, code, edict, decree, rule, regulation, ruling, injunction, judgment, order, assessment, writ or other legal requirement, administrative policy or guidance or requirement issued, enacted, adopted, promulgated, implemented or otherwise put into effect by or under the authority of any Governmental Entity.

“Merger” means the merger of JGGC with and into the Company upon the terms and subject to the conditions set forth in the Business Combination Agreement, the plan of merger relating to the Merger and in accordance with the applicable provisions of the Companies Act, whereupon the separate corporate existence of JGGC ceased and the Company continued its existence under the Companies Act as the surviving company.

“Nasdaq” means the Nasdaq Stock Market LLC.

“Ordinary Shares” means the ordinary shares of the Company, par value $0.0001 per share.

“Private Warrant” means a warrant of the Company to purchase one Ordinary Share that was issued upon conversion of a private placement warrant issued by JGGC in the Merger.

“Public Warrant” means a warrant of the Company to purchase one Ordinary Share that was issued upon conversion of a public warrant issued by JGGC in the Merger.

“Series I RSRs” means the 1,666,666.67 Series I restricted stock rights of the Company that will vest and be settled for an equal number of Ordinary Shares if, during the Earnout Period, the daily VWAP of the Ordinary Shares is greater than or equal to $12.00 for any twenty (20) Trading Days within any thirty (30) consecutive Trading Day period.

“Series II RSRs” means the 1,666,666.67 Series II restricted stock rights of the Company that will vest and be settled for an equal number of Ordinary Shares if, during the Earnout Period, the daily VWAP of the Ordinary Shares is greater than or equal to $14.00 for any twenty (20) Trading Days within any thirty (30) consecutive Trading Day period.

“Series III RSRs” means the 1,666,666.67 Series III restricted stock rights of the Company that will vest and be settled for an equal number of Ordinary Shares if, during the Earnout Period, the daily VWAP of the Ordinary Shares is greater than or equal to $16.00 for any twenty (20) Trading Days within any thirty (30) consecutive Trading Day period.

“PFIC” means passive investment foreign company.

“PCAOB” means the Public Company Accounting Oversight Board.

“Registration Rights Agreement” means the Registration Rights Agreement entered into at Closing by and among the Company, the JGGC Sponsor, certain former Captivision Korea Shareholders party thereto and the other parties thereto, which amended and restated the registration rights agreement, dated February 10, 2022, by and among JGGC, the JGGC Sponsor and other holders of JGGC securities party thereto.

“SEC” means the U.S. Securities and Exchange Commission.

‑ 3 ‑

“Securities Act” means the Securities Act of 1933, as amended.

“Share Swap Agreement” means the share swap agreement executed by Exchange Sub and Captivision Korea pursuant to the Business Combination Agreement.

“SLAM” means Super Large Architectural Media.

“Specified Period” means the later of (i) the date that is 180 days after the Closing and (ii) the VWAP for Ordinary Share being at least $12.50 for 20 Trading Days within any 30‑consecutive Trading Day period during the period following the Closing and ending on the five (5) year anniversary of the Closing.

“Sponsor Support Agreement” means the support agreement dated March 2, 2023 entered into between JGGC, the Company, Captivision Korea and the JGGC Sponsor.

“Transfer Agent” means Continental, the Company’s transfer agent.

“Treasury Regulations” shall mean the regulations promulgated by the U.S. Department of the Treasury pursuant to and in respect of provisions of the Code.

“Trust Account” means the trust account that held a portion of the proceeds from the IPO and the concurrent sale of the JGGC Private Placement Warrants and that was maintained by Continental Stock Transfer & Trust Company, acting as trustee.

“U.S.” means the United States.

“U.S. GAAP” means generally accepted accounting principles in the United States as in effect from time to time.

“VWAP” means for each Trading Day, the daily volume‑weighted average price for Ordinary Shares on Nasdaq during the period beginning at 9:30:01 a.m., New York time on such Trading Day and ending at 4:00:00 p.m., New York time on such Trading Day, as reported by Bloomberg through its “HP” function (set to weighted average).

“Warrants” means, collectively, the Converted Warrants and the Founder Warrants.

This annual report includes our (and our predecessor’s) audited consolidated financial statements for the years ended December 31, 2023, 2022 and 2021.

Our ordinary shares and warrants are listed on the Nasdaq Stock Market under the ticker symbols “CAPT” and “CAPTW,” respectively.

‑ 4 ‑

FORWARD‑LOOKING INFORMATION

This annual report on Form 20‑F contains forward‑looking statements. These forward‑looking statements include, without limitation, statements relating to expectations for future financial performance, business strategies or expectations for our respective businesses. These statements are based on the beliefs and assumptions of our management. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward‑looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. These statements constitute projections, forecasts and forward‑looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this annual report, words such as “anticipate”, “believe”, “can”, “continue”, “could”, “estimate”, “expect”, “forecast”, “intend”, “may”, “might”, “plan”, “possible”, “potential”, “predict”, “project”, “seek”, “should”, “strive”, “target”, “will”, “would” or the negative of such terms, and similar expressions, may identify forward‑looking statements, but the absence of these words does not mean that a statement is not forward‑looking.

The risks and uncertainties include, but are not limited to:

‑ 5 ‑

You are cautioned not to place undue reliance on these forward‑looking statements, which speak only as of the date of this annual report on Form 20‑F.

These forward‑looking statements are based on information available as of the date of this annual report on Form 20‑F and our management team’s current expectations, forecasts and assumptions, and involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which are outside our control and the control of our directors, officers and affiliates. Accordingly, forward‑looking statements should not be relied upon as representing our management team’s views as of any subsequent date. We do not undertake any obligation to update, add or to otherwise correct any forward‑looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

‑ 6 ‑

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not required.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not required.

ITEM 3. KEY INFORMATION

Not required.

Not required.

Summary of Risk Factors

Investing in our securities involves significant risks. You should carefully consider all of the information in this annual report before making an investment in our securities. Below please find a summary of the principal risks we face:

‑ 7 ‑

‑ 8 ‑

Risks Related to Our Industry and Company

The fourth‑generation architectural media glass industry is a nascent industry; it may take a long time for our technology to penetrate our target markets.

We believe we are the first and only provider of fourth generation architectural media glass. Unlike third generation architectural media glass, the fourth‑generation iteration is architecturally durable, fully transparent and is able to be installed in any structures where traditional architectural glass can be installed. However, despite its use in a variety of industries, such as hardware / equipment, software, media content and design, architectural media glass is mainly used for building exteriors and DOOH advertising, giving it limited uses in a somewhat limited market. Since the commercial trends of the fourth‑generation architectural media glass industry are still uncertain in this relatively nascent industry in which we are the sole player, we cannot assure you of the future growth of our G‑Glass technology. We further cannot assure you that our G‑Glass technology will be widely adopted or that it will penetrate any or all of our target markets in the near term, which may adversely affect our profitability.

Our future growth and success are dependent upon the DOOH market and the construction industry’s willingness to adopt architectural media glass and specifically our G‑Glass technology.

Our growth is highly dependent upon the adoption of architectural media glass by the construction industry and DOOH media industry. Although we anticipate growing demand for our products, there is no guarantee of such future demand, or that our products will remain competitive in the market.

Many of our potential customers in the construction industry are heavily invested in conventional building materials and may be resistant to new technology or unfamiliar products and services, in part due to health and safety concerns. Any perception of health and safety concerns, whether or not valid, may indirectly inhibit market acceptance of our products and services. Although we continue to expand our sales by successfully completing over 490 projects across multiple continents, our ability to continue to penetrate the market remains uncertain, as there is no guarantee that we will gain widespread market acceptance.

If the market for architectural media glass in general and our products in particular does not develop as we expect, or develops more slowly than we expect, or if demand for our products decreases, our business, prospects, financial condition and operating results could be harmed. The market for our products could be affected by numerous factors, such as:

‑ 9 ‑

Failure to maintain the performance, reliability and quality standards required by our customers could have a materially adverse impact on our financial condition and results of operation.

If our products or services have performance, reliability or quality problems, or our products are improperly installed (for instance, with incompatible glazing materials), we may experience additional warranty and service expenses, reduced or canceled orders, diminished pricing power, higher manufacturing or installation costs or delays in the collection of accounts receivable. Additionally, performance, reliability or quality claims from our customers, with or without merit, could result in costly and time‑consuming litigation that could require significant time and attention of management and involve significant monetary damages that could adversely affect our financial results.

Our business and results have been and may be adversely affected by fluctuations in the cost or availability of raw materials, components, purchased finished goods, shipping or services.

Although certain of the raw materials we use to produce G‑Glass, such as unique resin, IC semiconductor chips and LEDs, are manufactured through proprietary processes, we source all of our raw materials and components from a limited number of third‑party providers on an as‑needed basis. Mitigating volatility in certain commodities, such as oil, affecting all suppliers may result in additional price increases from time to time, regardless of the number and availability of suppliers. Our profitability and production could be negatively impacted by limitations inherent within the supply chains of certain of these component parts, including competitive, governmental, and legal limitations, natural disasters, and other events that could impact both supply and price.

Additionally, we are dependent on certain service providers for key operational functions, such as installation of finished goods. While there are a number of providers of these services, the cost to change service providers and set up new processes could be significant. Our ongoing efforts to improve the cost effectiveness, performance, quality, support, delivery and capacity of our products and services may reduce the number of providers we depend on, in turn increasing the risks associated with reliance on a single or a limited number of providers. Our results of operations would be adversely affected if we are unable to obtain adequate supplies of high‑quality raw materials, components or finished goods in a timely manner or make alternative arrangements for such supplies in a timely manner.

The enduring consequences of the COVID‑19 pandemic had an adverse impact on our business in both 2020 and 2021. Additionally, the simultaneous negative effects of the armed conflicts in Israel and Ukraine, coupled with a sluggish economic environment exacerbated by high‑interest rates, contributed to the disruptions of our supply chain for specific components throughout 2023. These disruptions resulted in increased prices for essential commodities such as glass, semiconductors, and aluminum, alongside increased shipping and warehousing costs. If these supply chain disruptions and shortages persist in the future, they could affect our ability to procure components for our products on a timely basis, or at all, or could require us to provide longer lead times to secure critical components by entering into longer term supply agreements. Alternatively, supply chain disruptions and shortages may require us to rely on spot market purchases at higher costs to obtain certain materials or products. Future increases in our costs and/or continued disruptions in the supply chain could negatively impact our profitability, as there can be no assurance that future price increases will be successfully passed through to customers. See “—Our business, results of operations and financial condition have been, and could continue to be, adversely affected by the COVID‑19 pandemic” and “—We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the military conflict between Russia and Ukraine and armed conflicts between Israel and Hamas. Our business, financial condition and results of operations may be materially and adversely affected by any negative impact on the global economy and capital markets resulting from the conflicts in Ukraine, the Gaza Strip or any other geopolitical tensions.”

A global economic downturn could result in reduced demand for our products and adversely affect our profitability.

In recent years, adverse conditions and volatility in the worldwide financial markets, fluctuations in oil and commodity prices and the general weakness of the global economy have contributed to the uncertainty of global economic prospects in general and have adversely affected, and may continue to adversely affect, the South Korean economy. Global economic downturns in the past have adversely affected demand for our products and services by our customers in South Korea and overseas.

The architectural media glass business is heavily influenced by the economic trends in the real estate, construction, and advertising industries, the governments’ spending abilities and the overall domestic and global economic fluctuations and economic growth trends. The uncertainty of the Biden administration’s policies and the U.S. Federal Reserve’s increase of the base interest rate may pose risks to economic recovery and growth. Additionally, the uncertainty arising out of the

‑ 10 ‑

European Union’s political environment, including the United Kingdom’s exit from the European Union, and China’s current regulations to cool down its overheated real estate market may curtail investor confidence.

We cannot provide any assurance that demand for our products can be sustained at current levels in future periods or that the demand for our products will not decrease in the future due to such economic downturns, which may adversely affect our profitability. We may decide to adjust our production levels in the future subject to market demand for our products, the production outlook of the global architectural media glass industry, any significant disruptions in our supply chain and global economic conditions in general. Any decline in demand for architectural media glass products may adversely affect our business, results of operations and/or financial condition.

Our short‑term profitability will be adversely impacted by our anticipated need to incur significant expenses in connection with the expansion of our staff and marketing efforts.

We plan to fund primarily marketing and sales personnel in our international jurisdictions in order to fuel growth. To date, the expenses and long lead times inherent in our efforts to pursue additional South Korean and international business opportunities have slowed, and are expected to continue to slow, the implementation of our expansion strategy, particularly in light of our ongoing capital constraints, and have limited, and are expected to continue to limit, the revenue that we receive as a result of our efforts to develop international business in the short term. Until we are able to increase our sales as a result of such investment, our short‑term profitability will be adversely impacted by the increased costs associated with investing in our expansion plans.

Our sales cycle for large projects is protracted, which makes our annual revenue and other financial metrics hard to predict.

For our Super Large Architectural Media (“SLAM”) installations, our sales cycles, which spans from initial commercial discussion to installation, is approximately four to five years on average, subject to a variety of factors including economic fluctuations and economic growth trends, supply chain disruptions and shortages, political climate changes and credit availability, all of which are out of our immediate control and which could cause delays at various stages of a SLAM installation.

The design and sales quotation phase of a SLAM project typically takes two to three years, followed by a two to three‑year construction phase. We ship and install our architectural media glass at the very end of the construction phase. The points at which we recognize revenue can be highly variable and tend to be determined on a case‑by‑case basis as a combination of when the initial order is placed, when the products are shipped, and when the products are installed and handed over to the customer. Revenue may be recognized at predetermined milestones during the lifecycle of a SLAM project, such as the point of the initial order, the shipment and installation. The longer the sales cycle for a particular project, the more unpredictable our ability to recognize the full potential revenue from such project. Extended sales cycles, without offsetting revenue from smaller projects with shorter sales cycles, can create volatile revenue swings from period to period. In addition, the expenses and long lead times inherent in pursuing SLAM projects have slowed Captivision Korea’s implementation of its strategy to pursue international business opportunities, particularly in light of Captivision Korea’s ongoing capital constraints, and have limited, and are expected to continue to limit, the revenue that Captivision Korea receives as a result of its efforts to develop international business in the short term. For a more detailed explanation of Captivision Korea’s revenue recognition strategy see “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Components of Results of Operations—Revenues.”

Our ability to realize revenues on our projects is subject to risks related to the financial health and condition of the real estate developers, and their suppliers or contractors, with whom we contract to supply our products. The financial distress or bankruptcy of such developers, and their suppliers and contractors, could result in our inability to realize revenues on contracted projects.

Our key customers include real estate developers and their suppliers and contractors. Because we depend on these customers for a significant portion of our revenue, if any of these real estate developers and their suppliers or contractors were to encounter financial difficulties affecting their ability to make payments, we may not be paid in full or at all on one or more contracted projects, which could adversely affect our operating results, financial position, and cash flows. Further, if any of our customers with whom we have billing or payment disputes seek bankruptcy protection, such dispute or bankruptcy will likely force us to incur additional costs in attorneys’ fees and fees for other professional consultants, which will negatively affect our revenue and profit.

‑ 11 ‑

Technological innovation by others could render our technology and the products produced using our process technologies obsolete or uneconomical.

Our success will depend on our ability to maintain a competitive position with respect to technological advances. Our technology and the products derived from our technology may be rendered obsolete or uneconomical by technological advances by others, more efficient and cost‑effective products, or entirely different approaches developed by one or more of our competitors or other third parties. Though we plan to continue to expend significant resources to enhance our technology platform and processes, there are no assurances we will be able to keep pace with technological change.

Our success depends partly upon our ability to enhance existing products and services and to develop new products and services through product development initiatives and technological advances; any failure to make such improvements could harm our future business and prospects.

We have continuously enhanced and improved our existing products and developed new products and services. We are devoting resources to the development of new products in all aspects of our business, including products that can reach a broader customer base. For example, we are working to diversify our customer base by offering smaller scale, mass market products such as bus shelter, bridge, showroom and handrail applications, which require less customization and allow us to generate revenue in a much shorter time frame than SLAM projects. We are also developing our “G‑Store,” an e‑platform where our customers can purchase various artworks and videos, and other media content, to be displayed on G‑Glass. Wherever and whenever our customers install G‑Glass, they will also use media content. Some of our customers have the capability to create their own content. However, the vast majority of our customers do not have their own content creation capability. This creates a secondary sales opportunity to sell media content to our customers. As such, we are developing our content platform, G‑Store. Our South Korean team, dedicated to creating media content, has created an aggregate of over 500 artworks and videos since 2017 to populate the G‑Store. The successful development of our products and product enhancements are subject to numerous risks, both known and unknown, including unanticipated delays, access to significant capital, budget overruns, technical problems and other difficulties that could result in the abandonment or substantial change in the design, development and commercialization of these new products. These events could have a materially adverse impact on our results of operations.

Given the uncertainties inherent with product development and introduction, including lack of market acceptance, we cannot provide assurances that any of our product development efforts will be successful on a timely basis or within budget, if at all. Failure to develop new products and product enhancements on a timely basis or within budget could harm our business and prospects. In addition, we may not be able to achieve the technological advances necessary for us to remain competitive, which could have a materially negative impact on our financial condition.

If our efforts to attract prospective clients and advertisers and to retain existing clients and users of our services are not successful, our growth prospects and revenue will be adversely affected.

Our ability to grow our business, including our DOOH delivery capabilities, and generate revenue depends on retaining, expanding and monetizing our customer base. In particular, our future growth depends in large part on G‑ Glass installation, adoption of our services and advertising revenue and content monetization across our DOOH business. We have focused on both developing longer‑term higher‑value SLAM projects in an effort to accelerate our growth and profitability and advancing smaller scale mass‑market products that we believe will provide greater earnings stability over time. As part of our effort to secure more SLAM projects, we are looking to introduce glass as a service (“GaaS”) globally, whereby we bear a portion of the maintenance and installation costs of each new G‑ Glass installation and license the use of the G‑Glass to third parties in exchange for a portion of the media and advertising revenue derived from the installation.

However, familiarizing prospective customers with and convincing them of the value proposition of our products and services require significant time and resources. Many of our existing and prospective clients are large property owners, developers and government agencies, and we often struggle to gain access to their ultimate decision makers. The expenses and long lead times inherent in pursuing SLAM projects have slowed the implementation of our strategy to pursue international business opportunities, particularly in light of our ongoing capital constraints, and have limited, and are expected to continue to limit, the revenue that we receive as a result of our efforts to develop international business in the short term. Furthermore, our ability to attract new clients, retain existing clients, and convert users of our G‑Glass to our value‑added services depends in large part on our ability to continue to offer compelling curated content, leading technologies and products, superior functionality, and an engaging customer experience.

‑ 12 ‑

Continued downward pricing of third generation products could adversely affect fourth generation architectural media glass pricing, which may affect our results of operations.

Although we are the only player in the fourth-generation iteration of architectural media façades, the pricing of third generation products still impacts our revenues in the DOOH media industry. The market for third generation display‑glass products is large and has attracted numerous new DOOH advertising media and media companies. As some companies have sought to compete based on price, they have created pricing pressures on architectural media glass, which we expect to continue in the future. If competitive forces drive down the prices we are able to charge for our products, our margins will shrink, which will adversely affect our ability to maintain our profitability and to invest in and grow our business.

Our revenue largely depends on continuing domestic and global demand for architectural media glass, large media displays, and associated digital content. Our sales may not grow at the rate we expect.

Currently, our total sales are derived principally from real estate developers, building owners, and to a lesser extent, governments. Going forward, our diversification strategy includes targeting more sales to content, applications and DOOH media. As each of these product segments significantly contributes to our total sales, we will continue to be dependent on continuing demand for our architectural media glass, large media displays and associated digital content from each of the construction industry, the remodeling industry and the DOOH media industry for a substantial portion of our sales. Any downturn in any of those industries in which our customers operate would result in reduced demand for our products, which may in turn result in reduced revenue, lower average selling prices and/or reduced margins.

If new construction levels out and repair and remodeling markets decline, such market pressures have, and may in the future, adversely affect our results of operations.

The architectural media glass industry is subject to the cyclical market pressures of the larger new construction and repair and remodeling markets. In turn, these larger markets have in the past been, and may in the future be, affected by adverse changes in economic conditions such as demographic trends, employment levels, interest rates, commodity prices, availability of credit and consumer confidence, as well as by changing needs and trends in the markets, such as shifts in customers’ preferences and architectural trends. Already, Captivision Korea’s revenue has been negatively affected by the ongoing environment of elevated interest rates in South Korea, which has delayed and/or reduced spending in the South Korean real estate industry, which historically has been our largest market. Any future downturn or any other negative market pressures could adversely affect our results of operations in the future, as margins may decrease as a direct result of an overall decrease in demand for our products. Additionally, we have additional idle manufacturing capacity which may have a negative effect on our cost structure.

If property developers, who make up our key customer base, continue to, or in the future, face operational and financial challenges, they may continue to, or in the future, change, delay or even cancel ongoing and planned projects. Since our architectural media glass products are installed at the very end of the construction process, at which point we have already, or would already have, incurred significant costs, such changes, delays or cancellations have had, or would have, a negative impact on our financial condition and results of operations.

Our government sector sales, which comprise a significant portion of our sales, may be adversely affected by presidential and congressional elections, policy changes, government land development plan changes and other local political events.

Our customers include national, provincial and local government entities. Our significant government sector sales are made primarily in South Korea. Political events such as pending presidential and congressional elections, the outcome of recent elections, changes in leadership among key executive decision makers, or revisions to government land development plans can affect our ability to secure new government contracts or the speed at which new contracts are signed, decrease future levels of spending and authorizations for programs that we bid on and/or shift spending priorities to programs in areas for which we do not provide products or services.

The IT, vertical real estate and large format wallscape sectors are regulated and any new or modified regulatory restrictions could adversely affect our sales and results of operations.

The IT, vertical real estate and large format wallscape sectors are subject to various laws, ordinances, rules and regulations concerning zoning, building design and safety, hurricane and floods, construction, and other similar matters. G‑Glass has been tested and successfully obtained various certifications required for electric safety as well as construction materials in

‑ 13 ‑

all of our key markets, including Korea Certification (KC), China Compulsory Certification (CCC), Conformité Européenne (CE) and Underwriter Laboratories (UL) certification. However, if we fail to maintain or renew these certifications, we are at risk of falling out of compliance with applicable laws, ordinances, rules and regulations, which will negatively affect our sales and results of operations. Further, increased regulatory restrictions could limit demand for our products and/or services, which could adversely affect our sales and results of operations. We may not be able to satisfy any future regulations, which consequently could have a negative effect on our sales and results of operations.

Changes in building codes could lower the demand for our G‑Glass technology.

The market for G‑Glass depends in large part on our ability to satisfy applicable state and local building codes. If the standards in such building codes are raised, we may not be able to meet such requirements, and demand for our products could decline. Conversely, if the standards in such building codes are lowered or are not enforced in certain areas, demand for our products may decrease in favor of cheaper alternatives. If we are unable to satisfy future regulations, including building code standards, it could adversely affect our sales and results of operations.

Certain jurisdictions have stricter regulations covering the types of products and services we offer, which may potentially deter us from entering or expanding within such jurisdictions in the future. For example, the Hong Kong government imposes stringent rules and requirements with respect to building codes and we may not invest additional resources to penetrate the Hong Kong market if the cost of meeting these requirements outweighs perceived economic gains.

We sometimes manage the installation of our products, which subjects us to risks and costs that may impact our profit margin.

From time to time, we plan and manage the installation of our products at our customers’ venues. The installation process subjects us to risks that are out of our immediate control, including construction delays, unexpected modifications, work stoppages, extreme weather conditions and operational hazards. In addition, we rely on various contractors and subcontractors to carry out each step of the construction and installation process, including brick, façade, insulation, windowpane and curtain glass installers, carpenters, electricians, painters and other contractors. Our reliance on third party contractors in combination with certain operational risks can result in delays, damages, replacements or repairs that may subject us to increased or unexpected costs and may affect our ability to complete installations in a timely manner.

Due to the number of contractors and workers on a construction site and the difficulty in identifying issues during the construction process, including delays in identifying latent leaks, intermittent electrical power or signal failures, or other issues, it is difficult to identify the root cause of certain issues that materialize during the installation process. This uncertainty may prevent us from assigning legal liability or requesting reimbursement from third party contractors, forcing us to fund any replacements or remedies necessary for the completion of the installation. As a result, our project margin may be adversely affected.

We sometimes rely on third‑party contractors for the installation of our products, which subjects us to risks and costs that are out of our control.

We may rely on third party contractors for the installation of our products at our customers’ venues. Such installation work is subject to various hazards and risks, including extreme weather conditions, work stoppages and operational hazards. If we are delayed or unable to complete installations due to a third‑party contractors’ failure to properly operate or if we experience significant changes in the cost of these services due to new or additional regulations, we may not be able to complete installations in a timely manner or make alternative arrangements for such installations in a timely manner. As installation costs represent a significant part of our cost structure, substantial increases in these costs would result in a material adverse effect on our revenues and costs of operations.

Additionally, the performance of such third‑party contractors is outside of our control, as a result, failures or deficiencies in the installations of third‑party contractors could have an adverse impact on our operating results.

We are subject to labor, health, construction/building and safety regulations, and may be exposed to liabilities and potential costs for lack of compliance.

We are subject to labor, health, construction/building and safety laws and regulations that govern, among other things, the relationship between us and our employees, and the health and safety of our employees. If an adverse final decision that we

‑ 14 ‑

violated any labor or health and safety laws is issued, we may be exposed to penalties and sanctions, including the payment of fines. Our subsidiaries could also be subject to work stoppages or closure of operations.

We rely on key researchers and engineers, senior management and production facility operators, and the loss of the services of any such personnel or the inability to attract and retain them may adversely affect our business.

Our success depends to an extent upon the continued service of our research and development and engineering personnel, as well as on our ability to continue to attract, retain and motivate qualified researchers and engineers, especially during periods of rapid growth. Our focus on rapid technological developments and advanced manufacturing processes has meant that we must aggressively recruit research and development personnel and engineers with expertise in cutting‑edge technologies.

We also depend on the services of experienced key senior management, and if we lose their services, it would be difficult to find and integrate replacement personnel in a timely manner, if at all. We also employ highly skilled line operators at our production facilities.

The loss of the services of a significant number of our key research and development and engineering personnel, senior management or skilled operators without adequate replacement, or the inability to attract new qualified personnel, may have an adverse effect on our operations.

Equipment failures, delays in deliveries and catastrophic loss at our manufacturing facilities could lead to production curtailments or shutdowns that prevent us from producing our products.

We have one operational state‑of‑the‑art manufacturing facility located in Pyeongtaek, South Korea, which currently fulfills all of the market demand for our products. In March 2020, our second manufacturing facility, located in Tianjin, China, temporarily suspended its operations as a result of COVID‑19 pandemic‑related restrictions imposed by the Chinese government on manufacturers. Our Chinese manufacturing facility has not yet restarted operations, and no concrete proposal has been made as to if, and when, operations might resume. Any interruption or significant disruption in production capabilities at our facilities stemming from equipment failures, insufficient personnel to operate our manufacturing facilities, or other reasons could result in our inability to manufacture our products, which would reduce our sales and earnings for the affected period. See “— We rely on production facility operators and manufacturing facility employees, and the loss of the services of any such personnel or the inability to attract and retain will adversely affect our business.”

In addition, as a result of the highly customizable nature of our products, we generally begin the manufacturing process after receiving an order from a customer rather than relying on pre‑existing inventory. If our manufacturing facilities experience any production stoppages, even if only temporarily, or any delays, delivery times could be severely affected. Any significant delay in deliveries to our customers could lead to increased product returns or cancellations and cause us to lose future sales. Our manufacturing facilities are also subject to the risk of loss due to unanticipated events such as fires, explosions, acts of terrorism or extreme weather conditions. Any plant shutdowns or periods of reduced production stemming from equipment failure, delays in deliveries or catastrophic loss, could have a material adverse effect on our results of operations or financial condition. Further, we may not have adequate insurance to compensate for all losses that result from any of these events.

We may be adversely affected by disruptions to our manufacturing facilities or disruptions to our customer, supplier or employee base.

Any disruption to our manufacturing facilities could damage a significant portion of our inventory and materially impair our ability to distribute our products to customers. We could incur significantly higher costs and longer lead times associated with distributing our products to customers during the time that it takes for us to reopen or replace a damaged facility. In addition, if there are disruptions to our customer and supplier base or to our employees caused by weather‑related events, acts of terrorism, pandemics, our ongoing capital constraints, or any other cause, our business could be temporarily adversely affected by decreased production capabilities, higher costs for materials, increased shipping and storage costs, increased labor costs, increased absentee rates and scheduling issues. Any interruption in the production or delivery of our supplies could reduce sales of our products and increase costs.

‑ 15 ‑

We rely on production facility operators and manufacturing facility employees, and the loss of the services of any such personnel or the inability to attract and retain will adversely affect our business.

Our success depends to an extent upon the continued service of our production facility operators and manufacturing facility personnel, especially for the completion of large‑scale projects and during periods of rapid growth. The recent loss of the services of a significant number of our manufacturing facility personnel and our inability to identify adequate replacements due to our ongoing capital constraints will have an adverse effect on our operations. In particular, our reduction in human capital has disrupted our production capabilities at our facilities for the production of one of our large‑scale projects, which we expect will lead to the delayed delivery of the product to our client. This delay will reduce our sales and earnings for the affected period and could lead to increased product returns or cancellations and cause us to lose future sales from this client.

We operate with a modest inventory, which may make it difficult for us to efficiently allocate capacity on a timely basis in response to changes in demand.

Our customers provide us with advance forecasts of their product requirements. However, due to the highly customizable nature of our components and large‑scale products in particular, firm orders are not placed until negotiations on purchase prices and construction timelines are finalized and definitive orders are placed several months prior to delivery.

As a result, firm orders may be less than anticipated based on these prior forecasts. Although we typically operate with an inventory level estimated for several months, it may be difficult for us to adjust production costs or to allocate production capacity in a timely manner to compensate for any such modifications in order volumes. Our inability to respond quickly to changes in overall demand for architectural media glass as well as changes in product mix and specifications may result in lost revenue, which would adversely affect our results of operations.

We may experience losses on inventories.

The customizable nature of most of our projects makes it difficult for us to maintain usable stock of finished or semi‑finished products. As a result, our inventory consists mostly of raw materials including, glass stocks, LEDs, aluminum extrusion, resins, adhesives, drivers, FPCBs and spacer tape, among other items. Our ability to fulfil orders in a timely manner regardless of their size is dependent on the maintenance of adequate reserves of raw materials in our inventory.

We manage our inventory based on our customers’ and our own forecasts and typically operate with an inventory level estimated for several months. Although adjustments are regularly made based on market conditions, we typically deliver our goods to the customers within several months after a firm order has been placed. While we maintain open channels of communication with our major customers to avoid unexpected decreases in firm orders or subsequent changes to placed orders, and try to minimize our inventory levels, such actions by our customers may have an adverse effect on our inventory management. Other factors affecting our inventory levels include the shelf life of our raw materials and the production capacity of our manufacturing facilities.

Any issues or delays in meeting our projected manufacturing costs and production capacity could adversely impact our business, prospects, operating results and financial condition.

Future events could result in issues or delays in further ramping our products and expanding production output at our existing and future operating lines. In order to achieve our volume and the anticipated ramp in production of our products, we must continue to sustain and ramp significant production at our existing production lines. We are not currently employing a full degree of automation in the manufacturing processes for our products. If we are unable to maintain production at our facilities, ramp output additionally over time as needed, and do so cost‑effectively, or if we are unable to attract, hire and retain, as we have been unable to do recently, a substantial number of highly skilled personnel, our ability to supply our products could be negatively impacted, which could adversely affect our brand and harm our business, prospects, financial condition and operating results. See “—We will require substantial additional financing to fund our operations and complete the development and commercialization of the process technologies that produce each of our products or new aspects of its existing process technologies that produce each of our products, and we may not be able to obtain such financing on favorable terms, or at all.”

‑ 16 ‑

Our failure to properly manage the distribution of our products and services could result in the loss of revenues and profits.

We utilize a direct sales force, as well as a network of distribution and integration partners, to market and sell our products and services. We are continually reviewing our go‑to‑market strategy to help ensure that we are reaching the most customers that we can and with the highest level of service. At times, this may require strategic changes to our sales organization or enlisting or dropping various distributors in certain regions, which could result in additional costs or operational challenges. Successfully managing the interaction of our direct and indirect sales channels to reach various potential customers for our products and services is a complex process. In addition, our reliance on indirect selling methods may reduce visibility to demand and pricing issues.

To support the expansion of our business internationally, we may decide to make changes to our operating structure in other countries when we believe these changes will make us more competitive by reaching additional customers, offering faster delivery, importation services, and/or local currency sales. These new operating models may require changes in legal structures, business systems, and business processes that may result in significant business disruption and negatively impact our customers’ experience, resulting in loss of sales. Furthermore, as we assume more responsibility for the importation of our products into other countries, we face higher compliance risk in adhering to local regulatory and trade requirements. Finally, the local stocking of our products in countries outside of our primary distribution centers may result in higher costs and increased risk of excess or obsolete inventory associated with maintaining the appropriate level and mix of stock in multiple inventory locations, resulting in lower gross margins.

Our go‑to‑market strategy has distinct risks and costs, and therefore, our failure to implement the most advantageous balance in the sales and operating model for our products and services could have a material adverse effect on our revenue and profitability.

Our business involves complex manufacturing processes that may cause personal injury or property damage, subjecting us to liabilities and possible losses or other disruptions of our operations in the future, which may not be covered by insurance.

Our business involves complex manufacturing processes. Some of these processes, such as various forms of durability testing, involve high pressures, temperatures and other hazards that present certain safety risks to workers employed at our manufacturing facilities. The potential exists for accidents involving death or serious injury. The potential liability resulting from any such accident to the extent not covered by insurance, could result in unexpected cash expenditures, thereby reducing the cash available to operate our business. Such an accident could disrupt operations at any of our facilities, which could adversely affect our ability to deliver products to our customers on a timely basis and to retain our current business.

Operating hazards inherent in our business, some of which may be outside of our control, can cause personal injury and loss of life, damage to or destruction of property, plant and equipment and environmental damage. We maintain insurance coverage in amounts and against the risks we believe are consistent with industry practice, but this insurance may not be adequate or available to cover all losses or liabilities we may incur in our operations. Our insurance policies are subject to varying levels of deductibles. Losses up to our deductible amounts accrue based upon our estimates of the ultimate liability for claims incurred and an estimate of claims incurred but not reported. However, liabilities subject to insurance are difficult to estimate due to unknown factors, including the severity of an injury, the determination of our liability in proportion to other parties, the number of incidents not reported and the effectiveness of our safety programs. If we were to experience insurance claims or costs above our estimates, we might also be required to use working capital to satisfy these claims.

Our business relies on our patent rights which may be narrowed in scope or found to be invalid or otherwise unenforceable.

Our success will depend, to a significant extent, on our ability to obtain and enforce our patent rights both in South Korea and worldwide. The coverage claimed in a patent application can be significantly reduced before a patent is issued, either in South Korea or abroad. Consequently, we cannot provide assurance that any of our pending or future patent applications will result in the issuance of patents. Patents issued to us may be subjected to further proceedings limiting their scope and may not provide significant proprietary protection or competitive advantage. Our patents also may be challenged, circumvented, invalidated or deemed unenforceable. In addition, because patent applications in certain countries generally are not published until more than 18 months after they are first filed, and because publication of discoveries in scientific or

‑ 17 ‑

patent literature often lags behind actual discoveries, we cannot be certain that we were, or any of our licensors was, the first creator of inventions covered by pending patent applications, that we or any of our licensors will be entitled to any rights in purported inventions claimed in pending or future patent applications, or that we were, or any of our licensors was, the first to file patent applications on such inventions.

Furthermore, pending patent applications or patents already issued to us or our licensors may become subject to dispute, and any dispute could be resolved against us. For example, we may become involved in re‑examination, reissue or interference proceedings and the result of these proceedings could be the invalidation or substantial narrowing of our patent claims. We also could be subject to court proceedings that could find our patents invalid or unenforceable or could substantially narrow the scope of our patent claims. In addition, depending on the jurisdiction, statutory differences in patentable subject matter may limit the protection we can obtain on some of our inventions.

Failure to protect our intellectual property rights could impair our competitiveness and harm our business and future prospects.

We believe that the fact that we produce G‑Glass from fully proprietary, self‑developed production machines and equipment, and are the only market player that can offer products of this kind at this time are critical to the success of our business. We take active measures to obtain international protection of our intellectual property by obtaining patents and undertaking monitoring activities in our major markets. However, we cannot assure you that the measures we are taking will effectively deter competitors from improper use of our proprietary technologies. Our competitors may misappropriate our intellectual property, disputes as to ownership of intellectual property may arise and our intellectual property may otherwise become known or independently developed by our competitors.

We may in the future be subject to claims that former employees, collaborators, or other third parties have an interest in our patents or other intellectual property as an inventor or co‑inventor. For example, we may have inventorship disputes arise from conflicting obligations of consultants or others who are involved in developing our products. Litigation may be necessary to defend against these and other claims challenging inventorship. If we fail in defending any such claims, in addition to paying monetary damages, we may lose valuable intellectual property rights, such as exclusive ownership of, or right to use, valuable intellectual property. Such an outcome could have a material adverse effect on our business. Even if we are successful in defending against such claims, litigation could result in substantial costs and be a distraction to management and other employees.

Any failure to protect our intellectual property could impair our competitiveness and harm our business and future prospects.

We are subject to potential exposure to environmental liabilities and are subject to environmental regulation and any such liabilities or regulation may adversely affect our costs and results of operations in the future.

Our manufacturing processes involve hazardous materials and generate industrial waste such as used glass containing resin at various stages in the manufacturing process, and we are subject to a variety of laws and regulations relating to the use, storage, discharge and disposal of waste substances, which are frequently changing and becoming more stringent. Although we have enacted safety measures, engaged in employee education on handling such materials and installed various types of safety equipment, consistent with industry standards, for the treatment of such industrial waste, engage a professional third party industrial waste management service provider and believe that our facilities are materially in compliance with such laws and regulations, we cannot provide assurance that our protocols will always be followed by our employees or the third party service provider and safety or environmental related claims will not be brought against us or that the local or national governments will not take steps toward adopting more stringent safety or environmental standards.

Furthermore, as owners of real property, our subsidiaries can be held liable for the investigation or remediation of contamination on such properties, in some circumstances, without regard to whether we knew of or were responsible for such contamination. Remediation may be required in the future because of spills or releases of hazardous substances, the discovery of unknown environmental conditions, or more stringent standards regarding existing residual contamination. Environmental regulatory requirements may become more burdensome, increase our general and administrative costs, the availability of construction materials, raw materials and energy, and increase the risk that our subsidiaries incur fines or penalties or be held liable for violations of such regulatory requirements. New regulations regarding climate change may also increase our expenses and eventually reduce our sales.

‑ 18 ‑

Earthquakes, tsunamis, floods, severe health epidemics (including any possible recurrence of COVID‑19 or other types of widespread infectious diseases) and other natural calamities could materially adversely affect our business, results of operations or financial condition.

If earthquakes, tsunamis, floods, fires, extreme weather events (whether as a result of climate change or otherwise), severe health epidemics or any other natural calamities were to occur in the future in any area where any of our assets, suppliers or customers are located, our business, results of operations or financial condition could be adversely affected. A number of suppliers of our raw materials, components and manufacturing equipment, as well as certain of our manufacturing facilities, are located in countries which have historically suffered natural calamities from time to time, such as China and South Korea. Any occurrence of such natural calamities in countries where our suppliers are located may lead to shortages or delays in the supply of raw materials, components or manufacturing equipment. In addition, natural calamities in areas where our customers are located, including South Korea, China, Japan, the United States and Europe, may cause disruptions in their businesses, which in turn could adversely impact their demand for our products. If we are unable to develop adequate plans to ensure that our business functions continue to operate during and after a disaster and to execute successfully on those plans in the event of a disaster or emergency, our business would be seriously harmed.

Future pandemics could have an adverse effect on our business.

Future pandemics could significantly impact the national and global economy and commodity and financial markets. For example, the COVID‑19 pandemic caused, among other things, extreme volatility in financial markets, a slowdown in economic activity, extreme volatility in commodity prices and a global recession. The response to COVID‑19 led to significant restrictions on travel, temporary business closures, quarantines and global stock market volatility.

While the impacts of COVID‑19 have diminished, any resurgence or new strains, or any future pandemics, may have further impacts on labor availability, consumable supply and transport logistics. Any future pandemics, or a resurgence, or new strains of COVID‑19 could lead to significant restrictions on travel and business closures. These travel restrictions and business closures may in the future adversely affect our operations, including our ability to obtain regulatory approvals and to sell our product, which could materially and adversely affect our business. The impacts of any future pandemics on our operational and financial performance will depend on various future developments, including the duration and spread of any new outbreak of an existing or new strain and the impact on regulatory agencies, customers, suppliers and employees.

We continue to face significant risks associated with our international expansion strategy.

We are continuing to seek new opportunities to produce and commercialize products using our process technologies outside the South Korea through entering into licensing and distribution with new and existing industry partners.

Overall, the expenses and long lead times inherent in our efforts to pursue international business opportunities have slowed, and are expected to continue to slow, the implementation of our expansion strategy, particularly in light of our ongoing capital constraints, and have limited, and are expected to continue to limit, the revenue that we receive as a result of our efforts to develop international business in the short term. More broadly, our international business operations are subject to a variety of risks, including:

‑ 19 ‑

Our inability to overcome these obstacles could harm our business, financial condition and operating results. Even if we are successful in managing these obstacles, our industry partners internationally are subject to these same risks and may not be able to manage these obstacles effectively.

Our financial results could vary significantly from quarter to quarter and are difficult to predict.

Our financial results could vary significantly from quarter to quarter because of a variety of factors, many of which are outside of our control and are difficult to predict. As a result, comparing our results of operations on a period‑to‑ period basis may not be meaningful. In addition to the risk factors stated herein, other factors that could cause our quarterly results of operations to fluctuate include:

‑ 20 ‑

Due to these and other factors, our financial results for any quarterly or annual period may not meet our expectations or the expectations of our investors and may not be meaningful indications of our future performance.

Our current liquidity resources raise substantial doubt about our ability to continue as a going concern and to comply with our debt covenants unless we raise additional capital to meet our obligations in the near term.