F-1/A: Registration statement for securities of certain foreign private issuers

Published on February 12, 2024

Table of Contents

As filed with the U.S. Securities and Exchange Commission on February 12, 2024.

Registration Statement No. 333-276243

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Captivision Inc.

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrants name into English)

| Cayman Islands | 3690 | Not Applicable | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

298-42 Chung-buk Chungang-ro Chung-buk,

Pyeong-taek, Gyounggi, Republic of Korea

Telephone: +82 70 5106 2804

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrants Principal Executive Offices)

Puglisi & Associates

850 Library Avenue, Newark, Delaware 19711

Telephone: (302) 738 6680

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent of Service)

Copies to:

R. William Burns

Paul Hastings LLP

600 Travis Street, Fifty-Eighth Floor

Houston, Texas 77002

(713) 860-7300

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (as amended, the Securities Act), check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| | The term new or revised financial accounting standard refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED FEBRUARY 12, 2024

CAPTIVISION INC.

Primary Offering of up to

24,204,377 Ordinary Shares

Secondary Offering of up to

37,745,130 Ordinary Shares

11,950,000 Warrants to Purchase Ordinary Shares

This prospectus relates to the offer and sale by Captivision Inc., a Cayman Islands exempted company, (us, we, Captivision or the Company), of (i) up to 11,950,000 ordinary shares, par value $0.0001 per share (Ordinary Shares) that are issuable by us upon the exercise of 11,950,000 private warrants of the Company, each exercisable at $11.50 for one Ordinary Shares (Private Warrants), (ii) up to 11,499,990 Ordinary Shares that are issuable by us upon exercise of 11,499,990 public warrants of the Company, each exercisable at $11.50 for one Ordinary Share (Public Warrants and, together with the Private Warrants, the Converted Warrants) and (iii) 754,387 Ordinary Shares for issuance upon cash exercise of Converted Options (as defined below).

This prospectus also relates to the offer and resale from time to time by the selling securityholders (including their transferees, donees, pledgees and other successors-in-interest) named in this prospectus (the Selling Securityholders) of up to (i) 7,666,667 Ordinary Shares (JGGC Founder Shares) that were issued to Jaguar Global Growth Partners I, LLC (the JGGC Sponsor) and the former directors and advisors of Jaguar Global Growth Corporation I, a Cayman Islands exempted company (JGGC), originally issued to the JGGC Sponsor, in exchange for Class B ordinary shares of JGGC in connection with JGGCs initial public offering (the JGGC IPO) (JGGC Sponsor and such officers and directors, the JGGC Founders), (ii) an aggregate of 5,000,000 Ordinary Shares (Earnout Shares) consisting of: (A) 1,666,666.67 Ordinary Shares issuable upon vesting of 1,666,666.67 Series I restricted stock rights of the Company (Series I RSRs), (B) 1,666,666.67 Earnout Shares issuable upon vesting of 1,666,666.67 Series II restricted stock rights of the Company (Series II RSRs) and (C) 1,666,666.67 Earnout Shares issuable upon vesting of 1,666,666.67 Series III restricted stock rights of the Company (Series III RSRs and together with the Series I RSRs and the Series II RSRS, the Earnout RSRs), in each case in accordance with the terms and conditions of the Earnout RSRs for issuance upon settlement of such Earnout RSRs if the volume-weighted average price (VWAP) of Ordinary Shares is greater than or equal to (a) $12.00, (b) $14.00, or (c) $16.00, respectively, in each case, for twenty (20) days on which trading in Ordinary Shares (each a Trading Day) within any thirty (30) consecutive Trading Day period occurring during the period commencing at Closing (as defined below) and ending on the third anniversary of the Closing (the Earnout Period), (iii) 6,284,512 Ordinary Shares held by certain parties to the registration rights agreement, dated as of November 15, 2023 (the Registration Rights Agreement), (iv) 142,000 Ordinary Shares issued to Cohen & Company Capital Markets pursuant to their engagement letter with JGGC, dated December 1, 2022, as amended on November 17, 2023 (v) up to 4,842,483 Ordinary Shares (Deferral Arrangement Shares) issuable upon conversion of up to $7.7 million of amounts owed to JGG SPAC Holdings LLC (JGG SPAC Holdings) and certain service providers, at a price equal to the VWAP Price (as defined elsewhere in this prospectus) pursuant to (A) a deferral agreement entered into by and among JGGC, JGG SPAC Holdings LLC, the Company and GLAAM (the JGGC SPAC Holdings Deferral Agreement) for the amount outstanding under a promissory note in favor of JGG SPAC Holdings LLC in the amount of $1,500,000 (the Working Capital Promissory Note), and (B) agreements entered into by and among a number of service providers the Company, GLAAM and JGGC (Deferred Fee Arrangements and together with the JGGC SPAC Holdings Deferral Agreement, the Deferral Agreements) assuming for the purposes of this prospectus, that the VWAP Price is $2.00, (vi) 20,000 Ordinary Shares issued to Outside The Box Capital Inc. pursuant to their marketing

Table of Contents

services agreement with JGGC, dated October 11, 2023, (vii) 1,779,368 Ordinary Shares issuable upon the exercise of the warrants held by Ho Joon Lee and Houng Ki Kim (the GLAAM Founders), each exercisable at $11.50 per Ordinary Share (Founder Warrants and, together with the Converted Warrants, the Warrants), (viii) 80,081 Ordinary Shares issuable upon the exercise of Converted Options held by certain parties to the Registration Rights Agreement, (ix) 11,950,000 Private Warrants that were issued to the JGGC Sponsor in connection with the JGGC IPO and (x) 11,950,000 Ordinary Shares issuable upon exercise of 11,950,000 Private Warrants (such securities described in clauses (i) through (x) collectively, the Resale Securities).

We are registering the offer and sale and/or resale of these securities to satisfy certain registration obligations we have and certain registration rights we have granted. The Selling Securityholders may offer all or part of the Resale Securities for resale from time to time through public or private transactions, at either prevailing market prices or at privately negotiated prices. The Resale Securities are being registered to permit the Selling Securityholders to sell Resale Securities from time to time, in amounts, at prices and on terms determined at the time of offering. The Selling Securityholders may sell the Resale Securities through ordinary brokerage transactions, in underwritten offerings, directly to market makers of our securities or through any other means described in the section entitled Plan of Distribution herein. In connection with any sales of Resale Securities offered hereunder, the Selling Securityholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be underwriters within the meaning of the Securities Act, or the Exchange Act. We are registering the Resale Securities for resale by the Selling Securityholders, or their donees, pledgees, transferees, distributees or other successors-in-interest selling our Ordinary Shares or Warrants or interests in our Ordinary Shares or Private Warrants received after the date of this prospectus from the Selling Securityholders as a gift, pledge, partnership distribution or other transfer.

Certain Resale Securities held by the Selling Securityholders party to the Registration Rights Agreement are subject to contractual lock-up restrictions that prohibit them from selling such securities at this time. In addition, the Ordinary Shares issuable pursuant to the Deferral Agreements may not be issued until April 13, 2024. See the section of this prospectus entitled Description of Securities.

On November 15, 2023 (the Closing Date), we consummated the business combination (the Business

Combination) contemplated by that certain business combination agreement, dated as of March 2, 2023, as amended as of June 16, 2023, July 7, 2023, July 18, 2023 and September 7, 2023 (the Business

Combination Agreement), by and among the Company, GLAAM Co., Ltd., a corporation (chusik hoesa) organized under the laws of the Republic of Korea (GLAAM), JGGC and Jaguar Global Growth Korea Co., Ltd.,

a stock corporation (chusik hoesa) organized under the laws of the Republic of Korea and wholly owned direct subsidiary of JGGC (Exchange Sub). Pursuant to the Business Combination Agreement, on the terms and subject

to the conditions set forth in the Business Combination Agreement, on the Closing Date (i) JGGC merged with and into the Company, with the Company surviving the merger (the Merger), (ii) immediately thereafter, the

Company (A) issued 17,109,472 Ordinary Shares, equal to the quotient of (1) $181,360,403.20, divided by (2) $10.60 (i.e., 17,109,472 Ordinary Shares issued in exchange for 21,365,404 GLAAM Common Shares (as defined below) at an exchange ratio

of 0.800820612130561, subject to rounding pursuant to the Business Combination Agreement) and (B) reserved up to 754,387 Ordinary Shares for issuance upon cash exercise of Converted Options (as defined below) (such number of Ordinary Shares

described in clauses (A) and (B), the Aggregate Share Swap Consideration), to Exchange Sub, and (iii) all shareholders of GLAAM (the GLAAM Shareholders) transferred their respective

common shares, par value W500 per share, of GLAAM (the GLAAM Common Shares), to Exchange Sub in connection with the exchange of GLAAM Common Shares for Ordinary Shares pursuant to the Business Combination

Agreement and, in exchange for the Aggregate Share Swap Consideration, Exchange Sub distributed all of the GLAAM Common Shares it received from GLAAM Shareholders to the Company (the Share Swap).

In connection with the Business Combination, holders of 7,949,289 shares of JGGC Class A ordinary shares, par value $0.0001 per share, issued in the JGGC IPO (the JGGC Class A Ordinary Shares) exercised their right to redeem their JGGC Class A Ordinary Shares for cash at a price of approximately $10.83 per share, for an aggregate price of approximately $86.1 million, which represented approximately 78.9% of the total JGGC Class A Ordinary Shares then outstanding. In addition, we paid an aggregate of $19.8 million paid to three

Table of Contents

investors (each, an NRA Investor) at Closing pursuant to their respective non-redemption agreements (the Non-Redemption Agreements), dated November 13, 2023, by and between JGGC and each NRA Investor on behalf of certain funds, investors, entities or accounts that are managed, sponsored or advised by each such NRA Investor or its affiliates. Pursuant to each Non-Redemption Agreement, each NRA Investor agreed to rescind or reverse any previously submitted redemption demand of the JGGC Class A Ordinary Shares held or acquired by such NRA Investor, provided the Company returned cash to such NRA Investor upon Closing in an amount so as to provide the NRA Investor with an effective investment price of $1.00 per share.

The Ordinary Shares being offered for resale by the Selling Securityholders pursuant to this prospectus represent approximately 54.2% of our total issued and outstanding Ordinary Shares on a fully diluted basis (assuming and after giving effect to the issuance of 23,449,990 Ordinary Shares upon exercise of all outstanding Converted Warrants, 1,779,368 Ordinary Shares upon exercise of all outstanding Founder Warrants, 5,000,000 Earnout Shares issuable upon vesting of all outstanding Earnout RSRs, 4,842,483 Ordinary Shares issuable pursuant to Deferral Agreements and 754,387 Ordinary Shares issuable upon exercise of all outstanding Converted Options) and the Warrants being offered for resale pursuant to this prospectus represent approximately 50.9% of our current total outstanding Warrants. Upon expiration of the contractual lock-up restrictions mentioned above, the Selling Securityholders, including the JGGC Sponsor (who is a beneficial owner of approximately 11.0% of our total issued and outstanding Ordinary Shares on a fully diluted basis), will be able to sell all of their Resale Securities registered for resale hereunder for so long as this registration statement of which this prospectus forms a part is available for use. Given the substantial number of Resale Securities being registered for potential resale by the Selling Securityholders pursuant to the registration statement of which this prospectus forms a part, the sale of such Resale Securities by the Selling Securityholders, or the perception in the market that the Selling Securityholders may or intend to sell all or a significant portion of such Resale Securities, could increase the volatility of the market price of our Ordinary Shares or Public Warrants or result in a significant decline in the public trading price of our Ordinary Shares or Public Warrants. The Selling Securityholders acquired, or have the option to acquire, the Ordinary Shares covered by this prospectus at prices ranging from less than $0.01 per share to $11.50 per share. Specifically, the JGGC Founders acquired the shares which converted into Ordinary Shares and the warrants that converted into Private Warrants in connection with the Business Combination at prices of approximately $0.004 per share and $1.00 per warrant, respectively. By comparison, the offering price to public shareholders in the JGGC IPO was $10.00 per unit, which consisted of one share, one right and one-half of one redeemable warrant. Consequently, certain Selling Securityholders may make a significant profit and in some circumstances even realize a positive rate of return on the sale of their Resale Securities covered by this prospectus even if the market price of Ordinary Share is below $10.00 per share, in which case public shareholders and/or warrantholders may experience a negative rate of return on their investment.

We will not receive any proceeds from the sale of the Resale Securities by the Selling Securityholders, except with respect to amounts received by us upon exercise of Warrants or Converted Options to the extent such Warrants or Converted Options are exercised for cash. Assuming the exercise of all outstanding Warrants for cash, we would receive aggregate proceeds of approximately $290.1 million. However, we will only receive such proceeds if all Warrant holders fully exercise their Warrants. The exercise price of the Public Warrants, Private Warrants and Founder Warrants is $11.50 per share. We believe that the likelihood that holders determine to exercise their Warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the market price of our Ordinary Shares. If the market price for our Ordinary Shares is less than the exercise price of the Warrants (on a per share basis), we believe that holders will be very unlikely to exercise any of their Warrants, and accordingly, we will not receive any such proceeds. There is no assurance that the Warrants will be in the money prior to their expiration or that the holders will exercise their Warrants. See the section entitled Risk Factors Risks Relating to Operating as a Public Company The Warrants and the Converted Options may never be in the money, and may expire worthless. Converted Warrant holders have the option to exercise their Converted Warrants on a cashless basis in accordance with the amended and restated warrant agreement, dated November 15, 2023, by and among the Company, JGGC and Continental Stock Transfer & Trust Company (the A&R Warrant Agreement). Holders of Founder Warrants have the option to exercise their Founder Warrants on a cashless basis in accordance with the terms of the Founder Warrants. To the extent that any Warrants are exercised on a cashless basis, the amount of cash we would receive from the exercise of Warrants will decrease. Assuming the exercise of all outstanding Converted Options for cash, we would receive aggregate proceeds of approximately $3.65 million. The exercise price of the Converted Options is $4.84 per

Table of Contents

share. We believe that the likelihood that holders determine to exercise their Converted Options, and therefore the amount of cash proceeds that we would receive, is dependent upon the market price of our Ordinary Shares. If the market price for our Ordinary Shares is less than the exercise price of the Converted Options (on a per share basis), we believe that holders will be very unlikely to exercise any of their Converted Options, and accordingly, we will not receive any such proceeds. There is no assurance that the Converted Options will be in the money prior to their expiration or that the holders will exercise their Converted Options. Holders of Converted Options have the option to exercise their Converted Options on a cashless basis in accordance with their terms. To the extent any Converted Options are exercised on a cashless basis, the amount of cash we would receive from the exercise of Converted Options will decrease.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision. Our Ordinary Shares and Public Warrants are listed on the Nasdaq Stock Market, (Nasdaq) under the trading symbols CAPT and CAPTW, respectively. On February 9, 2024, the closing prices for our Ordinary Shares and Public Warrants on Nasdaq were $7.65 per share and $0.12 per warrant, respectively.

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012 and are therefore eligible to take advantage of certain reduced reporting requirements applicable to other public companies.

We are also a foreign private issuer as defined in the Exchange Act and are exempt from certain rules under the Exchange Act that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions under Section 16 of the Exchange Act with respect to their purchases and sales of Ordinary Shares. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

We are a holding company incorporated in the Cayman Islands with our principal executive offices in South Korea. Our operations are conducted in South Korea and our subsidiaries in United Kingdom, China, Japan, Hong Kong and the United States. Throughout this prospectus, unless the context indicates otherwise, (1) references to Captivision, we or us refer to Captivision Inc. (formerly known as Phygital Immersive Limited), the registrant and the Cayman Islands holding company that is the current holding company of the group and its direct and indirect subsidiaries, (2) references to GLAAM refer to GLAAM Co., Ltd., a corporation (chusik hoesa) organized under the laws of South Korea and the headquarters and a wholly-owned subsidiary of Captivision, and (3) references to JGGC refer to Jaguar Global Growth Corporation I, a Delaware corporation, a blank check company which merged with and into Captivision as a result of the Business Combination, with Captivision surviving the Merger. GLAAM and its subsidiaries conduct Captivisions daily business operations. For a diagram depicting Captivisions corporate structure, see Prospectus SummaryOverviewStructure of Captivision.

Investors in our securities are investing in a Cayman Islands holding company rather than securities of our operating subsidiaries. Such structure involves unique risks to investors. In particular, because our principal executive offices are located in South Korea, and a substantial portion of our operations and assets are located in South Korea, we may face various legal and operational risks associated with doing business in South Korea. For a detailed description of the risks related to Captivisions holding company structure and doing business in South Korea and other countries in which we operate, see Risk FactorsRisks Related to South Korea and Other Countries Where We Operate.

As of the date of this prospectus, neither Captivision nor any of its subsidiaries have paid any dividends or distributions to their respective parent companies or to any investor, and the only transfers of cash among Captivision and its subsidiaries have been from Captivision to its subsidiaries for investments in its subsidiaries and for its subsidiaries working capital needs. As of the date of this prospectus, we have transferred an aggregate of approximately $1.8 million through regular commercial banks via wire transfer (in cash) to our subsidiaries as capital injections and cash advanced for working capital. For a detailed description of the financings amongst

Table of Contents

our subsidiaries, see Certain Relationships and Related Party Transactions. Any determination to pay dividends will be at the discretion of our board of directors. Currently, we do not anticipate that we would distribute earnings even after we become profitable and generate cash flows from operations. We do not currently have any cash management policy that dictates how funds must be transferred between us and our subsidiaries, or among our direct and indirect subsidiaries. If needed, we may transfer funds to our subsidiaries, by way of capital contributions or loans in accordance with the charter of the relevant subsidiaries and in compliance with applicable local laws and regulations. As an offshore holding company, we may use the proceeds of our offshore fund-raising activities to provide loans or make capital contributions to our subsidiaries, in each case subject to the satisfaction of government reporting, registration and approvals.

Investing in our securities involves a high degree of risk. See Risk Factors beginning on page 16 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the SEC nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

PROSPECTUS DATED , 2024

Table of Contents

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 8 | ||||

| 10 | ||||

| 14 | ||||

| 16 | ||||

| 56 | ||||

| UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

57 | |||

| NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS |

63 | |||

| 69 | ||||

| 70 | ||||

| 71 | ||||

| 80 | ||||

| 81 | ||||

| MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

101 | |||

| 148 | ||||

| 156 | ||||

| 161 | ||||

| 167 | ||||

| 185 | ||||

| 187 | ||||

| 190 | ||||

| 193 | ||||

| 194 | ||||

| 195 | ||||

| ENFORCEABILITY OF CIVIL LIABILITY UNDER U.S. SECURITIES LAWS |

196 | |||

| 197 | ||||

| F-1 | ||||

| II-1 | ||||

| II-8 |

You should rely only on the information contained or incorporated by reference in this prospectus or any supplement. Neither we nor the Selling Securityholders have authorized anyone else to provide you with different information. The securities offered by this prospectus are being offered only in jurisdictions where the offer is permitted. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since that date.

Except as otherwise set forth in this prospectus, neither we nor the Selling Securityholders have taken any action to permit a public offering of these securities outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of these securities and the distribution of this prospectus outside the United States.

i

Table of Contents

This prospectus is part of a registration statement on Form F-1 that we filed with the SEC. The Selling Securityholders named in this prospectus may, from time to time, sell the Resale Securities described in this prospectus in one or more offerings. We believe the likelihood that warrant holders will exercise their warrants, and therefore the amount of cash proceeds that we would receive, is dependent upon the trading price of our Ordinary Shares. If the market price for our Ordinary Shares is less than $11.50 per share, we believe the holders of Warrants will be less likely to exercise their Warrants. See Risk FactorsRisks Relating to Operating as a Public CompanyThe Warrants and the Converted Options may never be in the money, and may expire worthless. This prospectus includes important information about us, the securities being offered by us and the Selling Securityholders and other information you should know before investing. Any prospectus supplement may also add, update, or change information in this prospectus. If there is any inconsistency between the information contained in this prospectus and any prospectus supplement, you should rely on the information contained in that particular prospectus supplement. This prospectus does not contain all of the information provided in the registration statement that we filed with the SEC. You should read this prospectus together with the additional information about us described in the section below entitled Where You Can Find More Information. You should rely only on information contained in this prospectus, any prospectus supplement and any related free writing prospectus. We have not, and the Selling Securityholders have not, authorized anyone to provide you with information different from that contained in this prospectus, any prospectus supplement and any related free writing prospectus. The information contained in this prospectus is accurate only as of the date on the front cover of the prospectus. You should not assume that the information contained in this prospectus is accurate as of any other date.

The Selling Securityholders may offer and sell the Resale Securities directly to purchasers, through agents selected by the Selling Securityholders, or to or through underwriters or dealers. A prospectus supplement, if required, may describe the terms of the plan of distribution and set forth the names of any agents, underwriters or dealers involved in the sale of Resale Securities. See Plan of Distribution.

This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction to or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

1

Table of Contents

FINANCIAL INFORMATION PRESENTATION

Captivision

We qualify as a foreign private issuer as defined under Rule 405 under the Securities Act and will prepare our financial statements denominated in U.S. dollars and in accordance with International Financial Reporting Standards as adopted by the International Accounting Standards Board (IFRS). Accordingly, the unaudited pro forma combined financial information presented in this prospectus have been prepared in accordance with IFRS and denominated in U.S. dollars.

JGGC

The unaudited financial statements as of and for the six months ended June 30, 2023 and 2022, and the audited financial statements as of and for the year ended December 31, 2022 and as of and for the period from March 31, 2021 (inception) to December 31, 2021, are included in this prospectus. Such audited financial statements have been prepared in accordance with U.S. generally accepted accounting principles (U.S. GAAP) and are denominated in U.S. dollars.

GLAAM

The unaudited financial statements of GLAAM as of and for the six months ended June 30, 2023 and 2022 and the audited financial statements as of and for the years ended December 31, 2022 and 2021 included in this prospectus have been prepared in accordance with IFRS and are denominated in U.S. dollars.

2

Table of Contents

In this prospectus, we present industry data, information and statistics regarding the markets in which we compete as well as publicly available information, industry and general publications and research and studies conducted by third parties. This information is supplemented where necessary with our own internal estimates and information obtained from discussions with our customers, taking into account publicly available information about other industry participants and our managements judgment where information is not publicly available. This information appears in Managements Discussion and Analysis of Financial Condition and Results of Operations, Business and other sections of this prospectus.

Industry publications, research, studies and forecasts generally state that the information they contain has been obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus. These forecasts and forward-looking information are subject to uncertainty and risk due to a variety of factors, including those described under Risk Factors. These and other factors could cause results to differ materially from those expressed in any forecasts or estimates.

3

Table of Contents

The following terms used in this prospectus have the meanings indicated below:

Business Combination means the Merger, the Share Swap and the other transactions contemplated by the Business Combination Agreement, collectively.

Business Combination Agreement means the Business Combination Agreement, dated as of March 2, 2023, as amended as of June 16, 2023, July 7, 2023, July 18, 2023 and September 7, 2023 by and among JGGC, GLAAM, Jaguar Global Growth Korea Co., Ltd, and the Company.

Business Day shall mean any day other than a Saturday, a Sunday or other day on which commercial banks in New York, New York, Seoul, Republic of Korea or the Cayman Islands are authorized or required by Legal Requirements to close.

Captivision, the Company and we means Captivision Inc. (formerly known as Phygital Immersive Limited), an exempted company with limited liability under the laws of the Cayman Islands, together with its direct and indirect subsidiaries.

Closing means the consummation of the Business Combination.

Code means the U.S. Internal Revenue Code of 1986, as amended.

Companies Act means the Companies Act (As Revised) of the Cayman Islands.

Converted Options means the options to acquire Ordinary Shares issued upon conversion of the GLAAM Options, in each case subject to substantially the same terms and conditions as were applicable under the converted GLAAM Option, the number of Ordinary Shares (rounded down to the nearest whole share), determined by multiplying the number of GLAAM Common Shares subject to the converted GLAAM Option as of immediately prior to the Share Swap by the GLAAM Exchange Ratio, at an exercise price per GLAAM Common Share (rounded up to the nearest whole cent) equal to (x) the exercise price per GLAAM Common Share of the converted GLAAM Options divided by (y) the GLAAM Exchange Ratio.

Converted Warrants means, collectively, the Public Warrants and the Private Warrants.

DOOH means digital out of home.

Earnout Period means, with respect to the Earnout RSRs, the period commencing at Closing and ending on the third anniversary of the Closing.

Earnout Shares means the shares issuable upon settlement of the Earnout RSRs.

Earnout Strategic Transaction means the occurrence in a single transaction or as a result of a series of related transactions, of (i) a merger, consolidation, business combination, reorganization, recapitalization, liquidation, dissolution or other similar transaction with respect to the Company, in each case, in which shares of the Company are exchanged for cash, securities of another person or other property (excluding, for the avoidance of doubt, any domestication of the Company or any other transaction in which Ordinary Shares are exchanged for substantially similar securities of the Company or any successor entity of the Company) or (ii) the sale, lease or other disposition, directly or indirectly, by the Company of all or substantially all of the assets of the Company and its subsidiaries, taken as a whole (excluding any such sale or other disposition to an entity at least a majority of the combined voting power of the voting securities of which are owned by holders of Ordinary Shares).

Earnout RSRs means, collectively, the Series I RSRs, the Series II RSRs and the Series III RSRs.

4

Table of Contents

Equity Plan means the equity incentive plan for employees, directors and service providers of the Company and its subsidiaries in effect as of the Closing.

Exchange Act means the Securities Exchange Act of 1934, as amended.

Exchange Sub means Jaguar Global Growth Korea Co., Ltd., a stock corporation (chusik hoesa) organized under the laws of the Republic of Korea and wholly owned direct subsidiary of the Company.

Founder Warrants means the warrants held by the GLAAM Founders that are exercisable for an aggregate of 1,779,368 Ordinary Shares at $11.50 per share.

FPCB means flexible printed circuit board.

GaaS means glass as a service.

GLAAM means GLAAM Co., Ltd., a corporation (chusik hoesa) organized under the laws of the Republic of Korea and a subsidiary of the Company.

GLAAM Common Shares means the common shares, KRW 500 par value per share, of GLAAM.

GLAAM Exchange Ratio means 0.800820612130561.

GLAAM Founder Earnout Letter means the letter agreement, dated March 2, 2023, by and among the GLAAM Founders, the Company, Exchange Sub, JGGC and GLAAM, pursuant to which, at the Closing, issued or caused to be issued to the GLAAM Founders (in the aggregate), (i) the 1,666,666.67 Series I RSRs, (ii) the 1,666,666.67 Series II RSRs and (iii) the 1,666,666.67 Series III RSRs and setting forth the terms upon which such 5,000,000 Earnout RSRs shall vest and be settled for Ordinary Shares.

GLAAM Founders means Houng Ki Kim and Ho Joon Lee.

GLAAM Options means the options to purchase GLAAM Common Shares.

GLAAM Shareholders means the holders of GLAAM Common Shares.

Governmental Entity means (a) any federal, provincial, state, local, municipal, foreign, national or international court, governmental commission, government or governmental authority, department, regulatory or administrative agency, board, bureau, agency or instrumentality, tribunal, arbitrator or arbitral body (public or private), or similar body; (b) any self-regulatory organization; or (c) any political subdivision of any of the foregoing.

IASB means International Accounting Standards Board.

IC semiconductor chip means an integrated circuit chip.

IFRS means International Financial Reporting Standards, as issued by the IASB.

Investment Company Act means the Investment Company Act of 1940, as amended.

IRS means the U.S. Internal Revenue Service.

JGGC means Jaguar Global Growth Corporation I, a Cayman Islands exempted company.

JGGC Class A Ordinary Shares means JGGCs Class A ordinary shares, par value $0.0001 per share.

5

Table of Contents

JGGC Class B Ordinary Shares means JGGCs Class B ordinary shares, par value $0.0001 per share.

JGGC IPO means JGGCs initial public offering of units of JGGC, each consisting of one JGGC Class A Ordinary Share, one JGGC Right and one-half of one JGGC Public Warrant, which was consummated on February 10, 2022.

JGGC Rights means the rights entitling the holder thereof to receive one-twelfth of one JGGC Class A Ordinary Share.

JGGC Sponsor means Jaguar Global Growth Partners I, LLC, a Delaware limited liability company.

JGGC Sponsor Earnout Shares means 1,916,667 Ordinary Shares issued to JGGCs initial shareholders that are subject to vesting or forfeiture. JGGC Public Warrants means the redeemable warrants, each exercisable to purchase one JGGC Class A Ordinary Share.

JOBS Act means Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, as amended.

LED means light-emitting diode.

Legal Requirements means any federal, state, local, municipal, foreign or other law, statute, constitution, treaty, principle of common law, resolution, ordinance, code, edict, decree, rule, regulation, ruling, injunction, judgment, order, assessment, writ or other legal requirement, administrative policy or guidance or requirement issued, enacted, adopted, promulgated, implemented or otherwise put into effect by or under the authority of any Governmental Entity.

Merger means the merger of JGGC with and into the Company upon the terms and subject to the conditions set forth in the Business Combination Agreement, the plan of merger relating to the Merger and in accordance with the applicable provisions of the Companies Act, whereupon the separate corporate existence of JGGC ceased and the Company continued its existence under the Companies Act as the surviving company.

Nasdaq means the Nasdaq Stock Market LLC.

Ordinary Shares means the ordinary shares of the Company, par value $0.0001 per share.

Private Warrant means a warrant of the Company to purchase one Ordinary Share that was issued upon conversion of a private placement warrant issued by JGGC in the Merger.

Public Warrant means a warrant of the Company to purchase one Ordinary Share that was issued upon conversion of a public warrant issued by JGGC in the Merger.

Series I RSRs means the 1,666,666.67 Series I restricted stock rights of the Company that will vest and be settled for an equal number of Ordinary Shares if, during the Earnout Period, the daily VWAP of the Ordinary Shares is greater than or equal to $12.00 for any twenty (20) Trading Days within any thirty (30) consecutive Trading Day period.

Series II RSRs means the 1,666,666.67 Series II restricted stock rights of the Company that will vest and be settled for an equal number of Ordinary Shares if, during the Earnout Period, the daily VWAP of the Ordinary Shares is greater than or equal to $14.00 for any twenty (20) Trading Days within any thirty (30) consecutive Trading Day period.

6

Table of Contents

Series III RSRs means the 1,666,666.67 Series III restricted stock rights of the Company that will vest and be settled for an equal number of Ordinary Shares if, during the Earnout Period, the daily VWAP of the Ordinary Shares is greater than or equal to $16.00 for any twenty (20) Trading Days within any thirty (30) consecutive Trading Day period.

PFIC means passive investment foreign company.

PCAOB means the Public Company Accounting Oversight Board.

Registration Rights Agreement means the Registration Rights Agreement entered into at Closing by and among the Company, the JGGC Sponsor, certain former GLAAM Shareholders party thereto and the other parties thereto, which amended and restated the registration rights agreement, dated February 10, 2022, by and among JGGC, the JGGC Sponsor and other holders of JGGC securities party thereto.

SEC means the U.S. Securities and Exchange Commission.

Securities Act means the Securities Act of 1933, as amended.

Share Swap Agreement means the share swap agreement executed by Exchange Sub and GLAAM pursuant to the Business Combination Agreement.

SLAM means Super Large Architectural Media.

Specified Period means the later of (i) the date that is 180 days after the Closing and (ii) the VWAP for Ordinary Share being at least $12.50 for 20 Trading Days within any 30-consecutive Trading Day period during the period following the Closing and ending on the five (5) year anniversary of the Closing.

Sponsor Support Agreement means the support agreement dated March 2, 2023 entered into between JGGC, the Company, GLAAM and the JGGC Sponsor.

Transfer Agent means Continental, the Companys transfer agent.

Treasury Regulations shall mean the regulations promulgated by the U.S. Department of the Treasury pursuant to and in respect of provisions of the Code.

Trust Account means the trust account that held a portion of the proceeds from the IPO and the concurrent sale of the JGGC Private Placement Warrants and that was maintained by Continental Stock Transfer & Trust Company, acting as trustee.

U.S. means the United States.

U.S. GAAP means generally accepted accounting principles in the United States as in effect from time to time.

VWAP means for each Trading Day, the daily volume-weighted average price for Ordinary Shares on Nasdaq during the period beginning at 9:30:01 a.m., New York time on such Trading Day and ending at 4:00:00 p.m., New York time on such Trading Day, as reported by Bloomberg through its HP function (set to weighted average).

Warrants means, collectively, the Converted Warrants and the Founder Warrants.

White & Case means White & Case LLP.

7

Table of Contents

This prospectus contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements include, without limitation, statements relating to expectations for future financial performance, business strategies or expectations for the Companys respective businesses. These statements are based on the beliefs and assumptions of the management of the Company. Although the Company believe that its plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, it cannot assure you that it will achieve or realize these plans, intentions or expectations. These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this prospectus, words such as anticipate, believe, can, continue, could, estimate, expect, forecast, intend, may, might, plan, possible, potential, predict, project, seek, should, strive, target, will, would or the negative of such terms, and similar expressions, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The risks and uncertainties include, but are not limited to:

| | the ability to raise financing in the future and to comply with restrictive covenants related to indebtedness; |

| | the ability to realize the benefits expected from the Business Combination; |

| | the significant market adoption, demand and opportunities in the construction and DOOH media industries for GLAAMs products; |

| | the ability to maintain the listing of the Ordinary Shares and the Public Warrants on Nasdaq; |

| | the ability of GLAAM to remain competitive in the fourth generation architectural media glass industry in the face of future technological innovations; |

| | the ability of GLAAM to execute its international expansion strategy; |

| | the ability of GLAAM to protect its intellectual property rights; |

| | the profitability of GLAAMs larger projects, which are subject to protracted sales cycles; |

| | whether the raw materials, components, finished goods and services used by GLAAM to manufacture its products will continue to be available and will not be subject to significant price increases; |

| | the IT, vertical real estate and large format wallscape modified regulatory restrictions or building codes; |

| | the ability of GLAAMs manufacturing facilities to meet their projected manufacturing costs and production capacity; |

| | the future financial performance of the Company and GLAAM; |

| | the emergence of new technologies and the response of our customer base to those technologies; |

| | the ability of the Company and GLAAM to retain or recruit, or to effect changes required in, their respective officers, key employees or directors; |

| | the ability of the Company and GLAAM to comply with laws and regulations applicable to its business; and |

| | other risks and uncertainties indicated in this prospectus, including those set forth under the section of this prospectus entitled Risk Factors beginning on page 16. |

8

Table of Contents

These forward-looking statements are based on information available as of the date of this prospectus and the Companys management teams current expectations, forecasts and assumptions, and involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which are outside the control of the Company and its directors, officers and affiliates. Accordingly, forward-looking statements should not be relied upon as representing the Company management teams views as of any subsequent date. The Company does not undertake any obligation to update, add or to otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

9

Table of Contents

Overview

Captivision is a holding company incorporated in the Cayman Islands on February 24, 2023, with principal executive offices in South Korea. We conduct our operations through GLAAM, one of our wholly-owned subsidiaries in the Republic of South Korea, and its subsidiaries in the United Kingdom, China, Japan, Hong Kong and the United States. We are the exclusive developer, manufacturer and installer of an innovative architectural media glass product called G-Glass. G-Glass is the worlds first IT-enabled construction material that transforms buildings into extraordinary digital content delivery devices. We are a market leader in the delivery of fully transparent media façade capabilities with over 460 architectural installations worldwide. Founded in South Korea in 2005, GLAAM is now a vertically integrated manufacturer controlling almost every aspect of product assembly and installation, including assembling media glass laminates, manufacturing aluminum frames, developing electronics, operating software, and delivering products.

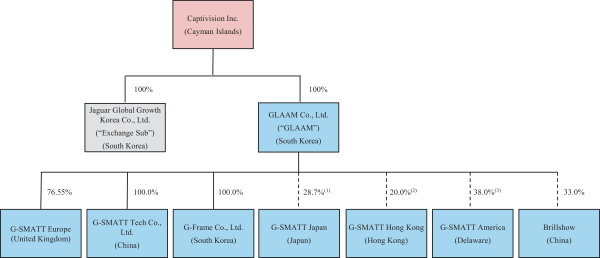

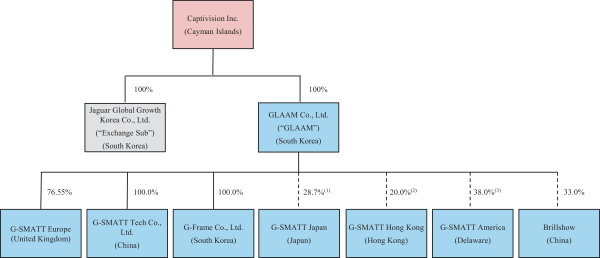

Structure of Captivision

The following diagram depicts the simplified organizational structure of the Company and its subsidiaries:

| (1) | Excludes G-Frames 11.4% Ownership |

| (2) | Excludes G-Frames 7.4% Ownership |

| (3) | Excludes G-Frames 16.6% Ownership |

Status as Emerging Growth Company (Page 145)

We are an emerging growth company as defined in the JOBS Act. The Company will remain an emerging growth company until the earliest to occur of (i) the last day of the fiscal year (a) following the fifth anniversary of the IPO, (b) in which the Company has total annual gross revenue of at least $1.235 billion or (c) in which the Company is deemed to be a large accelerated filer, which means the market value of Ordinary Shares held by non-affiliates exceeds $700 million as of the last business day of the Companys prior second fiscal quarter, and (ii) the date on which the Company issued more than $1.0 billion in non-convertible debt during the prior three-year period. The Company may take advantage of exemptions from various reporting requirements that are applicable to most other public companies, whether or not they are classified as emerging growth companies, including, but not limited to, an exemption from the provisions of Section 404(b) of the

10

Table of Contents

Sarbanes-Oxley Act requiring that the Companys independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting and reduced disclosure obligations regarding executive compensation. If some investors find the Company less attractive as a result, there may be a less active trading market for the Companys securities and the prices of securities may be more volatile.

Foreign Private Issuer

Captivision is a foreign private issuer as defined in the Exchange Act. As a foreign private issuer, we are exempt from certain rules under the Exchange Act, including certain disclosure and procedural requirements applicable to proxy solicitations under Section 14 of the Exchange Act, our board, officers and principal shareholders are exempt from the reporting and short-swing profit recovery provisions of Section 16 of the Exchange Act with respect to their purchases and sales of our Ordinary Shares, and we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as companies whose securities are registered under the Exchange Act but are not foreign private issuers. Foreign private issuers are also not required to comply with Regulation Fair Disclosure (Regulation FD), which restricts the selective disclosure of material non-public information. Accordingly, there may be less publicly available information concerning Captivision than there is for companies whose securities are registered under the Exchange Act but are not foreign private issuers, and such information may not be provided as promptly as it is provided by such companies. As a foreign private issuer, the Company is also permitted to follow certain home country corporate governance practices in lieu of the requirements of the Nasdaq Marketplace Rules (the Nasdaq Rules) pursuant to Nasdaq Rule 5615(a)(3), which provides for such exemption to compliance with the Nasdaq Rule 5600 Series. We rely on the exemptions available to foreign private issuers listed in the section entitled Management Corporate Governance Practices, and we may rely on additional exemptions in the future.

Risk Factors (Page 16)

Our business is subject to numerous risks and uncertainties, including those highlighted in the section entitled Risk Factors immediately following this prospectus summary, that represent challenges that we face in connection with the successful implementation of our strategy and the growth of our business. In particular, the following considerations, among others, may offset our competitive strengths or have a negative effect on our business strategy, which could cause a decline in the price of our securities and result in a loss of all or a portion of your investment. Some of these risks include, but are not limited to:

| | The Company will require substantial additional financing to fund its operations and complete the development and commercialization of the process technologies that produce each of its products or new aspects of its existing process technologies that produce each of its products, and the Company may not be able to obtain such financing on favorable terms, or at all. |

| | Unpaid transaction expenses, the costs of certain fee deferral arrangements and the issuances of additional Ordinary Shares under certain of the Companys contracts and arrangements may result in dilution of holders of Ordinary Shares and have a negative impact on the Companys results of operation, the Companys liquidity and/or the market price of the Ordinary Shares. |

| | The fourth-generation architectural media glass industry is a nascent industry; it may take a long time for GLAAMs technology to penetrate its target markets. |

| | GLAAMs future growth and success is dependent upon the DOOH market and the construction industrys willingness to adopt architectural media glass and specifically its G-Glass technology. |

| | Failure to maintain the performance, reliability and quality standards required by GLAAMs customers could have a materially adverse impact on its financial condition and results of operation. |

11

Table of Contents

| | GLAAMs business and results have been and, may in the future be, adversely affected by fluctuations in the cost or availability of raw materials, components, purchased finished goods, shipping or services. |

| | A global economic downturn could result in reduced demand for GLAAMs products and adversely affect its profitability. |

| | GLAAMs sales cycle for large projects is protracted, which makes its annual revenue and other financial metrics hard to predict. |

| | Technological innovation by others could render GLAAMs technology and the products produced using its process technologies obsolete or uneconomical. |

| | GLAAMs financial projections are subject to significant risks, assumptions, estimates and uncertainties. As a result, its actual revenues, market share, expenses and profitability may differ materially from expectations. |

| | GLAAMs success depends upon its ability to develop new products and services and enhance existing products and services through product development initiatives and technological advances; any failure to make such improvements could harm its future business and prospects. |

| | GLAAMs government sector sales, which comprise a significant portion of its sales, may be adversely affected by presidential and congressional elections, policy changes, government land development plan changes and other local political events. |

| | The IT, vertical real estate and large format wallscape sectors are regulated and any new or modified regulatory restrictions could adversely affect GLAAMs sales and results of operations. |

| | Changes in building codes could lower the demand for GLAAMs G-Glass technology. |

| | GLAAM sometimes manages the installation of its products, which subjects it to risks and costs that may impact its profit margin. |

| | GLAAM sometimes relies on third-party contractors for the installation of its products, which subjects it to risks and costs that are out of its control. |

| | GLAAM is subject to labor, health, construction/building and safety regulations, and may be exposed to liabilities and potential costs for lack of compliance. |

| | Equipment failures, delays in deliveries and catastrophic loss at GLAAMs manufacturing facilities could lead to production curtailments or shutdowns that prevent it from producing its products. |

| | GLAAM may be adversely affected by disruptions to its manufacturing facilities or disruptions to its customer, supplier or employee base. |

| | GLAAM operates with a modest inventory, which may make it difficult for it to efficiently allocate capacity on a timely basis in response to changes in demand. |

| | GLAAMs business involves complex manufacturing processes that may cause personal injury or property damage, subjecting it to liabilities and possible losses or other disruptions of its operations in the future, which may not be covered by insurance. |

| | Failure to protect GLAAMs intellectual property rights could impair its competitiveness and harm its business and future prospects. |

| | Earthquakes, tsunamis, floods, severe health epidemics (including the sustained outbreak of the global COVID-19 virus and any possible recurrence of other types of widespread infectious diseases) and other natural calamities could materially adversely affect GLAAMs business, results of operations or financial condition. |

12

Table of Contents

| | GLAAM continues to face significant risks associated with its international expansion strategy. |

| | GLAAMs results of operations are subject to exchange rate fluctuations, which may affect its costs and revenues. |

| | GLAAM is subject to the risks of operations in the United Kingdom, China, Japan, Hong Kong and the United States. |

| | The securities being offered in this prospectus represent a substantial percentage of our outstanding Ordinary Shares. The Selling Securityholders purchased the securities covered by this prospectus at different prices, some significantly below the current trading price of such securities, and may therefore make substantial profits upon resales. |

| | The Warrants and the Converted Options may never be in the money, and may expire worthless. |

| | The unaudited pro forma condensed combined financial information included in this prospectus may not be indicative of what the Companys actual financial position or results will be. |

| | The Company relies on production facility operators and manufacturing facility employees, and the loss of the services of any such personnel or the inability to attract and retain will adversely affect our business. |

13

Table of Contents

The summary below describes the principal terms of the offering. The Description of Securities section of this prospectus contains a more detailed description of our Ordinary Shares and Warrants.

| Issuer |

Captivision Inc. |

| Ordinary Shares offered by us |

Up to 24,204,377 Ordinary Shares, consisting of: (i) 11,950,000 Ordinary Shares that are issuable by us upon the exercise of 11,950,000 Private Warrants, (ii) 11,499,990 Ordinary Shares that are issuable by us upon exercise of 11,499,990 Public Warrants and (iii) 754,387 Ordinary Shares for issuance upon cash exercise of Converted Options. |

| Ordinary Shares that may be offered and sold from time to time by the Selling Securityholders |

Up to 37,745,130 Ordinary Shares, including (i) 7,666,667 Ordinary Shares that were issued to JGGC Founders in respect of Founder Shares, (ii) 5,000,000 Earnout Shares, (iii) 6,284,512 Ordinary Shares held by certain parties to the Registration Rights Agreement, (iv) 142,000 Ordinary Shares issued to Cohen & Company Capital Markets pursuant to their engagement letter with JGGC, dated December 1, 2022, as amended on November 17, 2023, (v) 4,842,483 Deferral Arrangement Shares, (vi) 20,000 Ordinary Shares issued to Outside The Box Capital Inc. pursuant to their marketing services agreement with JGGC, dated October 11, 2023, (vii) 1,779,368 Ordinary Shares issuable upon the exercise of Founder Warrants, (viii) 80,081 Ordinary Shares issuable upon the exercise of Converted Options held by certain parties to the Registration Rights Agreement and (ix) 11,950,000 Ordinary Shares issuable upon exercise of 11,950,000 Private Warrants. |

| Warrants that may be offered and sold from time to time by the Selling Securityholders |

11,950,000 Private Warrants. |

| Terms of offering |

We will issue Ordinary Shares (i) upon exercise of Converted Warrants pursuant to the terms of the A&R Warrant Agreement, (ii) upon exercise of Founder Warrants pursuant to the terms of the Founder Warrants and upon exercise of Converted Options pursuant to the terms thereof. |

| The Resale Securities offered for resale by this prospectus may be offered and sold at prevailing market prices, privately negotiated prices or such other prices as the Selling Securityholders may determine. See Plan of Distribution. |

| Terms of Warrants |

Each Converted Warrant entitles the holder to purchase one Ordinary Shares at an exercise price of $11.50 per share, subject to adjustment pursuant to the terms of the A&R Warrant Agreement. |

| The Founder Warrants are exercisable for an aggregate of 1,779,368 Ordinary Shares at $11.50 per share, subject to adjustment pursuant to the terms of the Founder Warrants. |

| All Warrants expire on November 15, 2028 at 5:00 p.m., New York City time. |

14

Table of Contents

| Transfer restrictions |

The 6,284,512 Ordinary Shares, held by or issuable to, the RRA Parties, and 11,950,000 Private Warrants are not transferrable for a period of six (6) months after the Closing, which is May 15, 2024, on the terms and subject to the conditions set forth in the Registration Rights Agreement. |

| Warrants issued and outstanding (as of the date of this prospectus) |

11,499,990 Public Warrants, 11,950,000 Private Warrants and Founder Warrants exercisable for up to 1,779,368 Ordinary Shares. |

| Voting Rights |

Each registered holder of our Ordinary Shares is entitled to one vote for each Ordinary Share of which he, she or it is the registered holder, subject to any rights and restrictions for the time being attached to any share. Unless specified in the memorandum and articles of association of the Company (the Governing Documents), or as required by applicable provisions of the Cayman Companies Law or applicable stock exchange rules, an ordinary resolution, being, the affirmative vote of shareholders holding a majority of the shares which, being so entitled, are voted thereon in person or by proxy at a quorate general meeting of the company or a unanimous written resolution of all of our shareholders entitled to vote at a general meeting of the Company, is required to approve any such matter voted on by our shareholders. Approval of certain actions, such as amending the Governing Documents, reducing our share capital, registration of our Company by way of continuation in a jurisdiction outside the Cayman Islands and merger or consolidation with one or more other constituent companies, requires a special resolution under Cayman Islands law and pursuant to the Governing Documents, being the affirmative vote of shareholders holding a majority of not less than two-thirds of the shares which, being so entitled, are voted thereon in person or by proxy at a quorate general meeting of the Company or a unanimous written resolution of all of our shareholders entitled to vote at a general meeting of the company. |

| Use of proceeds |

We will not receive any of the proceeds from the sale of the Resale Securities by the Selling Securityholders except with respect to amounts received by us due to the exercise of the Warrants or Converted Options for cash. We expect to use the proceeds received from such exercises, if any, for working capital and general corporate purposes. However, for so long as the Warrants are out of the money, we believe the holders thereof will be unlikely to exercise their Warrants. See Use of Proceeds. |

| Dividend Policy |

We have not paid any cash dividends on our Ordinary Shares to date. The payment of cash dividends in the future will be dependent upon our revenues and earnings, if any, capital requirements and general financial condition. Subject to the foregoing, the payment of cash dividends in the future, if any, will be at the discretion of the board of directors. |

| Market for our Ordinary Shares and Public Warrants |

Our Ordinary Shares and Public Warrants are listed on Nasdaq under the symbols CAPT and CAPTW, respectively. |

15

Table of Contents

Investing in our securities involves risks. You should carefully consider the risks described below and the other information contained in this prospectus, including the financial statements and notes to the financial statements included herein, in evaluating your decision to buy our securities. These risk factors are not exhaustive and investors are encouraged to perform their own investigation with respect to the business, cash flows, financial condition and results of operations of GLAAM and the Company. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may have a material adverse effect on the business, cash flows, financial condition and results of operations of Captivision. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. Our business, financial condition or results of operations could be materially and adversely affected by any of these risks. The risk factors described below are not necessarily exhaustive and you are encouraged to perform your own investigation with respect to the business of the Company. Unless the context otherwise requires, references in this Risk Factors to we, us, our, and the Company are intended to mean the business and operations of GLAAM and its consolidated subsidiaries prior to the Closing of the Business Combination and to Captivision and its consolidated subsidiaries following the Closing of the Business Combination.

Risks Related to Our Industry and Company

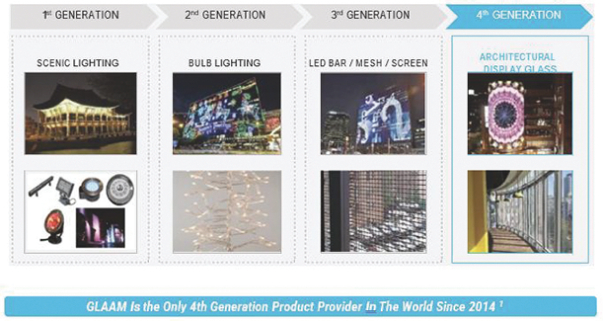

The fourth-generation architectural media glass industry is a nascent industry; it may take a long time for our technology to penetrate our target markets.

We believe we are the first and only provider of fourth generation architectural media glass. Unlike third generation architectural media glass, the fourth-generation iteration is architecturally durable, fully transparent and is able to be installed in any structures where traditional architectural glass can be installed. However, despite its use in a variety of industries, such as hardware / equipment, software, media content and design, architectural media glass is mainly used for building exteriors and DOOH advertising, giving it limited uses in a somewhat limited market. Since the commercial trends of the fourth-generation architectural media glass industry are still uncertain in this relatively nascent industry in which we are the sole player, we cannot assure you of the future growth of our G-Glass technology. We further cannot assure you that our G-Glass technology will be widely adopted or that it will penetrate any or all of our target markets in the near term, which may adversely affect our profitability.

Our future growth and success are dependent upon the DOOH market and the construction industrys willingness to adopt architectural media glass and specifically our G-Glass technology.

Our growth is highly dependent upon the adoption of architectural media glass by the construction industry and DOOH media industry. Although we anticipate growing demand for our products, there is no guarantee of such future demand, or that our products will remain competitive in the market.

Many of our potential customers in the construction industry are heavily invested in conventional building materials and may be resistant to new technology or unfamiliar products and services, in part due to health and safety concerns. Any perception of health and safety concerns, whether or not valid, may indirectly inhibit market acceptance of our products and services. Although we continue to expand our sales by successfully completing over 460 projects across multiple continents, our ability to continue to penetrate the market remains uncertain, as there is no guarantee that we will gain widespread market acceptance.

If the market for architectural media glass in general and our products in particular does not develop as we expect, or develops more slowly than we expect, or if demand for our products decreases, our business, prospects, financial condition and operating results could be harmed. The market for our products could be affected by numerous factors, such as:

| | perceptions about G-Glass features, quality, safety, performance and cost; |

16

Table of Contents

| | competition, including from other types of architectural media glass or traditional architectural glass; |

| | the cost premium for G-Glass in contrast to traditional architectural glass; |

| | government regulations and economic incentives; |

| | reduced construction activity, including as a result of the short and long-term effect of the COVID-19 pandemic; and |

| | concerns about our future viability. |

Failure to maintain the performance, reliability and quality standards required by our customers could have a materially adverse impact on our financial condition and results of operation.

If our products or services have performance, reliability or quality problems, or our products are improperly installed (for instance, with incompatible glazing materials), we may experience additional warranty and service expenses, reduced or canceled orders, diminished pricing power, higher manufacturing or installation costs or delays in the collection of accounts receivable. Additionally, performance, reliability or quality claims from our customers, with or without merit, could result in costly and time-consuming litigation that could require significant time and attention of management and involve significant monetary damages that could adversely affect our financial results.

Our business and results have been and may be adversely affected by fluctuations in the cost or availability of raw materials, components, purchased finished goods, shipping or services.

Although certain of the raw materials we use to produce G-Glass, such as unique resin, IC semiconductor chips and LEDs, are manufactured through proprietary processes, we source all of our raw materials and components from a limited number of third-party providers on an as-needed basis. Mitigating volatility in certain commodities, such as oil, affecting all suppliers may result in additional price increases from time to time, regardless of the number and availability of suppliers. Our profitability and production could be negatively impacted by limitations inherent within the supply chains of certain of these component parts, including competitive, governmental, and legal limitations, natural disasters, and other events that could impact both supply and price.

Additionally, we are dependent on certain service providers for key operational functions, such as installation of finished goods. While there are a number of providers of these services, the cost to change service providers and set up new processes could be significant. Our ongoing efforts to improve the cost effectiveness, performance, quality, support, delivery and capacity of our products and services may reduce the number of providers we depend on, in turn increasing the risks associated with reliance on a single or a limited number of providers. Our results of operations would be adversely affected if we are unable to obtain adequate supplies of high-quality raw materials, components or finished goods in a timely manner or make alternative arrangements for such supplies in a timely manner.

The enduring consequences of the COVID-19 pandemic had an adverse impact on our business in both 2020 and 2021. Additionally, the simultaneous negative effects of the armed conflict between Russia and Ukraine, coupled with a sluggish economic environment exacerbated by high-interest rates, contributed to the disruptions of our supply chain for specific components throughout the first half of 2023. These disruptions resulted in increased prices for essential commodities such as glass, semiconductors, and aluminum, alongside increased shipping and warehousing costs. If these supply chain disruptions and shortages persist in the future, they could affect our ability to procure components for our products on a timely basis, or at all, or could require us to provide longer lead times to secure critical components by entering into longer term supply agreements. Alternatively, supply chain disruptions and shortages may require us to rely on spot market purchases at higher costs to obtain certain materials or products. Future increases in our costs and/or continued disruptions in the

17

Table of Contents

supply chain could negatively impact our profitability, as there can be no assurance that future price increases will be successfully passed through to customers. See Our business, results of operations and financial condition have been, and could continue to be, adversely affected by the COVID-19 pandemic and The armed conflict between Russia and Ukraine, including sanctions and tensions between the United States along with several other countries and Russia, may adversely affect the results of our operations.

A global economic downturn could result in reduced demand for our products and adversely affect our profitability.

In recent years, adverse conditions and volatility in the worldwide financial markets, fluctuations in oil and commodity prices and the general weakness of the global economy have contributed to the uncertainty of global economic prospects in general and have adversely affected, and may continue to adversely affect, the South Korean economy. Global economic downturns in the past have adversely affected demand for our products and services by our customers in South Korea and overseas.

The architectural media glass business is heavily influenced by the economic trends in the real estate, construction, and advertising industries, the governments spending abilities and the overall domestic and global economic fluctuations and economic growth trends. The uncertainty of the Biden administrations policies and the U.S. Federal Reserves increase of the base interest rate may pose risks to economic recovery and growth. Additionally, the uncertainty arising out of the European Unions political environment, including the United Kingdoms exit from the European Union, and Chinas current regulations to cool down its overheated real estate market may curtail investor confidence.

We cannot provide any assurance that demand for our products can be sustained at current levels in future periods or that the demand for our products will not decrease in the future due to such economic downturns, which may adversely affect our profitability. We may decide to adjust our production levels in the future subject to market demand for our products, the production outlook of the global architectural media glass industry, any significant disruptions in our supply chain and global economic conditions in general. Any decline in demand for architectural media glass products may adversely affect our business, results of operations and/or financial condition.

Our short-term profitability will be adversely impacted by our anticipated need to incur significant expenses in connection with the expansion of our staff and marketing efforts.

We plan to fund primarily marketing and sales personnel in our international jurisdictions in order to fuel growth. To date, the expenses and long lead times inherent in our efforts to pursue additional South Korean and international business opportunities have slowed, and are expected to continue to slow, the implementation of our expansion strategy, particularly in light of our ongoing capital constraints, and have limited, and are expected to continue to limit, the revenue that we receive as a result of our efforts to develop international business in the short term. Until we are able to increase our sales as a result of such investment, our short-term profitability will be adversely impacted by the increased costs associated with investing in our expansion plans.

Our sales cycle for large projects is protracted, which makes our annual revenue and other financial metrics hard to predict.